INTRODUCTION

The Business Responsibility and Sustainability Reporting (BRSR) framework has been a focal point for listed companies over the past few years, emphasizing transparency and accountability in sustainability practices. While companies have made significant strides in adapting to this reporting format, the first year of assurance for the top 150 listed companies by market capitalization posed challenges. The assurance process applied to non-financial data mirrored the stringent approach historically used for financial data, which has evolved over decades. Discussions with several corporates revealed that including value chain disclosures in BRSR requirements for the top 250 listed companies has added a significant compliance burden. This, coupled with the absence of a clear methodology or guidance for data collection, has created challenges for companies in gathering extensive information (BRSR Core) from their value chain partners, leading to operational complexities. Companies communicated these practical difficulties to the Securities Exchange Board of India (SEBI).

To facilitate ease of doing business regarding BRSR, an expert committee was convened, which provided SEBI with recommendations aimed at simplifying the process and enhancing ease of compliance. Building on these insights, SEBI issued a consultation paper earlier this year, inviting feedback from stakeholders on the proposed recommendations.

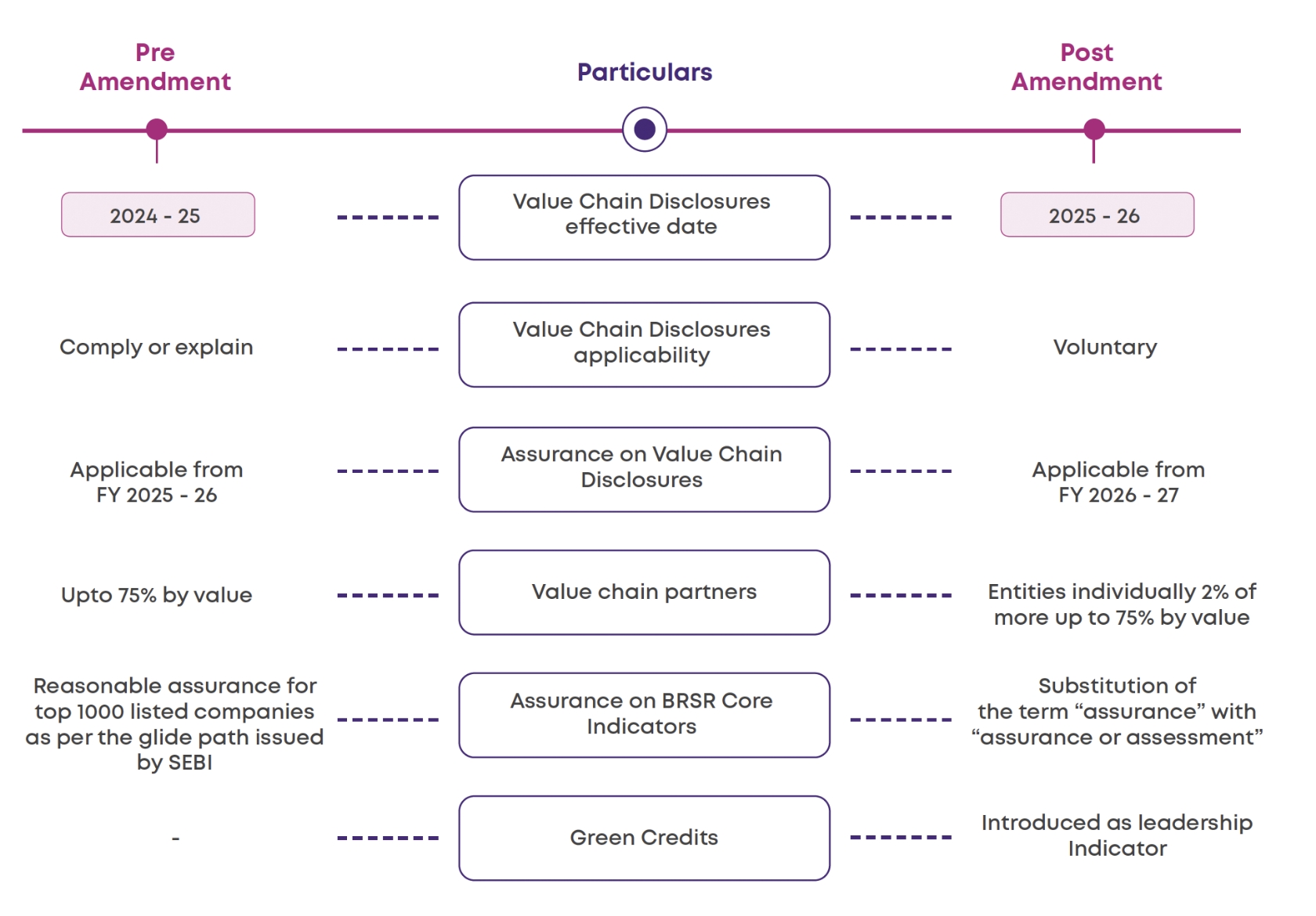

In its 18 December 2024 meeting, SEBI introduced amendments to the BRSR framework, addressing value chain disclosures and assurance requirements and adding a new leadership indicator. The before and after impact of the key amendments are summarized in the table below:

On 20 December 2024, SEBI issued a circular mandating listed entities to adhere to industry standards to comply with SEBI’s requirements for BRSR Core disclosures. This document delves into the global landscape shaping sustainability expectations, the specific demands stakeholders place on companies in this evolving context, and the broader implications of the recently issued circular. By aligning with these global trends and stakeholder priorities, companies can better navigate the challenges and opportunities presented by these new directives. Stay tuned as we explore what this means for corporate strategies and compliance efforts.

VALUE CHAIN SUSTAINABILITY: FOCUS AREAS AND REGULATORY IMPACT

As the focus on Environmental, Social, and Governance (ESG) continues to grow, there is an increasing shift towards robust reporting on companies’ ESG parameters and their entire value chain. Value chain of an organization covers its supply chain of obtaining raw material, services, products etc as well as distributors, dealers and customers. Understanding the value chain is essential for companies looking to optimize processes, improve efficiency, and gain a competitive edge.

In today’s sustainability-focused landscape, integrating sustainable practices across the value chain is no longer optional but essential. Collaborating with value chain partners committed to advanced ESG practices is a strategic move, enabling organizations to mitigate risks, enhance resilience, and secure long-term success in an evolving global market. Regulators are responding to this shift by establishing robust standards that ensure transparency across the supply chain.

In Europe, the Corporate Sustainability Reporting Directive (CSRD) now mandate comprehensive value chain disclosures, holding companies accountable for sustainability practices throughout their network. The International Sustainability Standards Board (ISSB) that has issued two IFRS standards, S1 and S2, also requires entities to evaluate sustainability-related risks and opportunities in the organization’s value chain. Similarly, in India, SEBI has integrated value chain disclosures into the BRSR, along with clear timelines for implementation. These developments highlight the growing expectation for businesses to address ESG factors not just within their operations but across their entire value chain.

In the past SEBI had mandated the top 250 listed entities to report relevant KPIs from the BRSR Core for their value chain, encompassing the top upstream and downstream partners cumulatively comprising 75% of their purchases/sales (by value) respectively from the Financial Year (FY) 2024-25 onwards. Collating and reporting data on value chain disclosures covering 75% of a listed ‘s total purchases and total sales is a detailed and time-consuming process.

Key considerations for assessing and supporting value chain partners

In our view, companies looking at evaluating disclosures from their value chain partners on a voluntary basis should consider the following:

- Implement an Effective Value Chain Program: Align partners with companies’ sustainability goals through a structured program.

- Confirm Code of Conduct Adherence: Ensure value chain partners follow a clear ESG-focused code of conduct. Ensure that the contracts with value chain partners permit require them to confirm and report on ESG parameters including audit rights.

- Enable Effective ESG Integration: Support partners in overcoming obstacles and implementing ESG practices by conducting capacity building workshops and offering assistance.

- Ongoing ESG Reporting & Validation: Require partners to report their ESG initiatives with assurance or assessments to ensure transparency.

- Leverage technology: Work with value chain partners to implement technology platforms that aid and simplify reporting and collation of data from several value chain partners.

- Confirm the Credibility of Sustainability Pledges: Confirming sustainability pledges with value chain partners ensures that commitments are credible and backed by real actions.

By focusing on these areas, businesses can strengthen their ESG efforts and foster transparency and trust across their entire value chain.

EASING ASSURANCE REQUIREMENTS FOR BRSR CORE INDICATORS

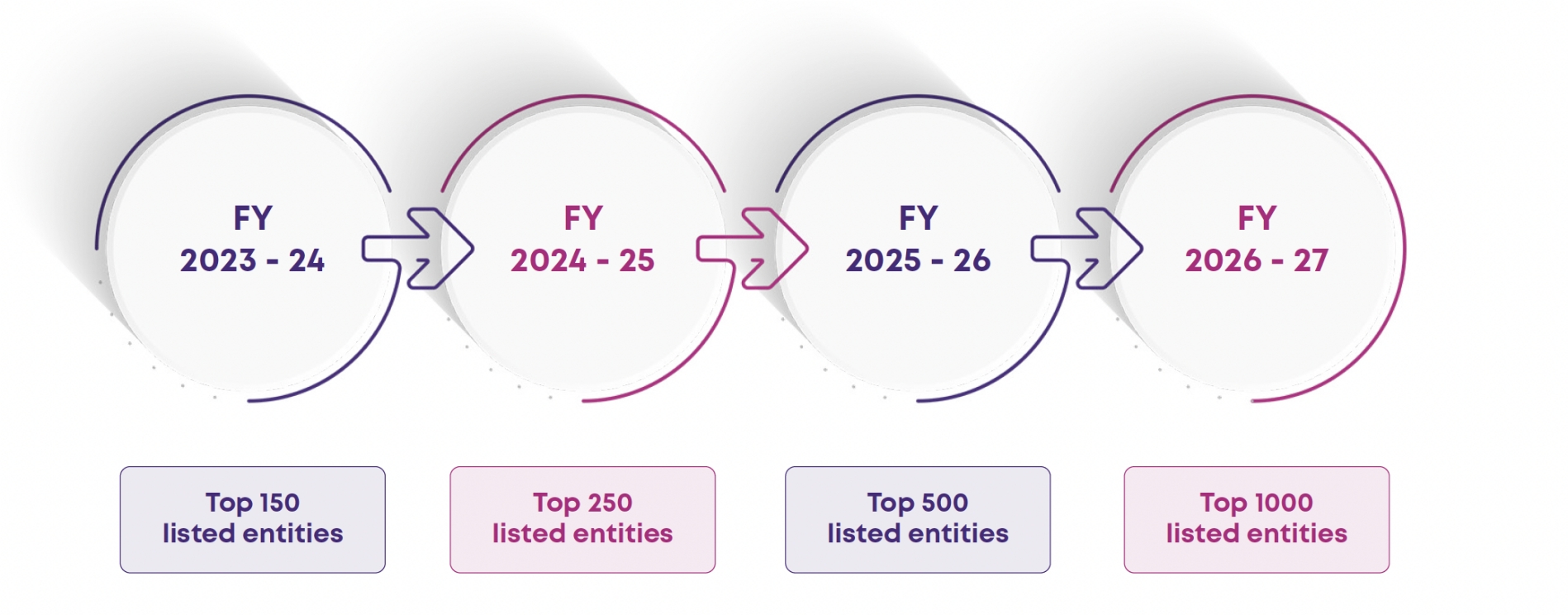

SEBI has announced a phased approach outlining the applicability of assurance provisions for the BRSR Core disclosures of the top 1,000 listed entities. The details of this glide path are provided below for reference:

The process of obtaining reasonable assurance entailed significant difficulties for companies given that the requirements for reporting on BRSR are recent. International frameworks, such as the CSRD, mandate external assurance of disclosed information. Initially, this requires limited assurance, with the aim of transitioning to reasonable assurance over the coming years.

To ease the provisions, the SEBI has substituted the term “assurance” with “assurance or assessment,” allowing companies the flexibility to choose between getting their data assured or assessed by a third party moving forward.

However, the guidance has not clearly outlined the approach that third-party assurance providers should follow while performing an organization’s assessment process.

The importance of having ESG data assured or assessed by a third party goes beyond merely ensuring regulatory compliance and managing risks. It plays a crucial role in building trust with stakeholders, investors, and key parties, reinforcing a company’s commitment to sustainable practices. Third-party assurance enhances brand reputation and credibility, showcasing a company’s dedication to transparency and responsibility. It also fosters customer confidence and satisfaction, as consumers are increasingly drawn to businesses with verified ESG credentials. Moreover, third-party assessment drives efficiency, identifying opportunities for continuous improvement in sustainability efforts, ultimately benefiting both the organization and its wider community.

To ensure data’s accurate deployment and integrity for assurance purposes, companies must strengthen their internal processes and documentation. This can be achieved by developing detailed process documents and risk control matrices, which facilitate testing processes and controls, including IT controls. Leveraging technology platforms will be key to ensuring accurate data collation, providing users with guidance to input data, maintaining a clear data trail, and ensuring thorough reviews of the reported information. Additionally, engaging with subject matter experts is essential to guarantee that data collation and reporting align with regulatory requirements. Companies can also utilize the Internal Control – Integrated Framework (ICIF) guidance issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) to establish a robust internal control framework, covering areas such as the control environment, risk assessment, control activities, and monitoring, to support effective and compliant ESG reporting.

GUIDANCE FOR DEVELOPING THE BRSR CORE INDICATORS

The SEBI released the “Industry Standards on Reporting of BRSR Core” on 20 December 2024, offering guidance on the preparation of BRSR and addressing various reporting nuances. Furthermore, the guidance covers examples of reporting under the BRSR Core indicators especially in cases where an organization is yet to streamline the data gathering processes. ISF may release additional guidance on the assessment process to be followed by assurance providers for the verification of ESG disclosures, ensuring consistency and reliability in the evaluation framework.

The ISF standards are divided into two parts: Part A, which addresses general requirements, including intensity-based calculations and clarifies the spend-based approach for estimating environmental footprints, and Part B, which provides a detailed explanation of requirements across all nine attributes. In the PDF, we have summarized the key clarifications covered under the latest Industry standards note.

NEW ADDITION: GREEN CREDITS TO FEATURE IN LEADERSHIP INDICATOR REPORTING

In the Union Budget for FY 2023-24, the government proposed that the Green Credit Programme (GCP) be notified under the Environment (Protection) Act, 1986. This initiative encourages companies to adopt environmentally sustainable practices by incentivizing actions that contribute to a greener, more sustainable future.

The “Green Credit Rules, 2023” were officially notified on 12 October 2023, with the Indian Council of Forestry Research and Education (ICFRE) designated as the programme’s administrator. Building on this, on 22 February 2024, the Ministry of Environment, Forest, and Climate Change (MoEFCC) published the methodology for calculating green credits for tree plantation activities.

Under these rules, the green credits earned through tree plantation can be reported under the ESG leadership indicator, further reinforcing companies’ commitment to sustainability.

Additionally, India and the UAE’s Global Green Credit Initiative (GGCI), introduced at COP-28, aims to incentivize eco-restoration efforts globally by issuing Green Credits. The proposed green credit disclosure in BRSR aligns with the goals of the GGCI, creating a unified approach to promoting pro-planet actions both locally and internationally.

IN CONCLUSION

The recent changes based on the expert committee recommendations and industry feedback aim to refine the assurance process and create a more supportive framework for companies on their sustainability journey. These updates ease the facilitation of business with respect to BRSR compliance and provide organizations with the opportunity to plan and integrate ESG disclosures from their value chain.

Additionally, companies can use this time to establish policies and procedures for implementing systems from an assurance perspective, ensuring a smoother transition to enhanced disclosure practices.