CSCRF highlights the importance of governance and supply chain risk Management, and at the same time, it focuses on evolving security guidelines such as data classification and localization, Application Programming Interface (API) security, Security Operations Centre (SOC), and measuring its efficacy, Software Bill of Materials (SBOM), etc.

Security Operations Centre (SOC)

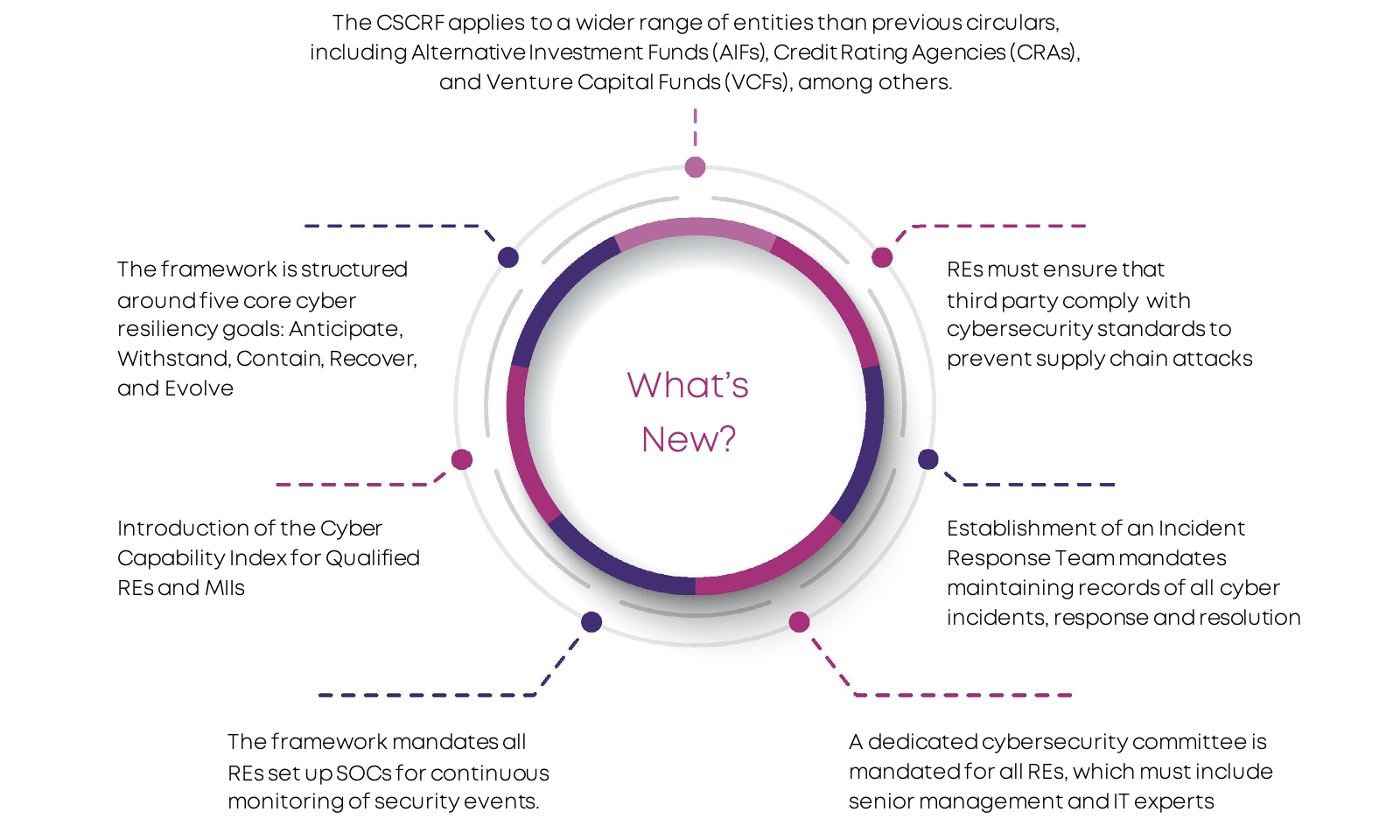

CSCRF mandates that all REs establish appropriate security monitoring mechanisms through a Security Operation Centre (SOC). The SOC can be onboarded through the RE’s own/ group SOC, market SOC, or any other third-party managed SOC.

Software Bill of Materials (SBOM)

REs to maintain a formal record containing the details and supply chain relationships of various components, such as open-source code, commercial components, etc., used in building software. The SBOM enumerates these components in a product.

Data Classification & Localization

All the data generated (including creation and storage) within the legal boundaries of India remains within the legal boundaries of India. CSCRF has provided standards on Data Localization for:

- Regulatory Data

- IT and Cybersecurity Data

VAPT after Major Change/ Major Release

CSCRF has mandated VAPT after every major release. Few example of major release(s)/ change(s):

- Implementation of a new SEBI circular.

- Changes in core versions of software

- Introduction of new security protocols

Application Programming interface (API) security

Application Programming Interface (API) security and Endpoint security solutions shall be implemented with rate limiting, throttling, and proper authentication and authorization mechanisms.

Cybersecurity and Quantum Computing

To mitigate the risk of Quantum Computing enabling breaking of the asymmetric cryptographic systems, REs have been provided guidelines, such as:

- Maintain inventory of cryptographic assets

- Explore the feasibility to adopt PQC and technologies like Quantum Key Distribution (QKD)