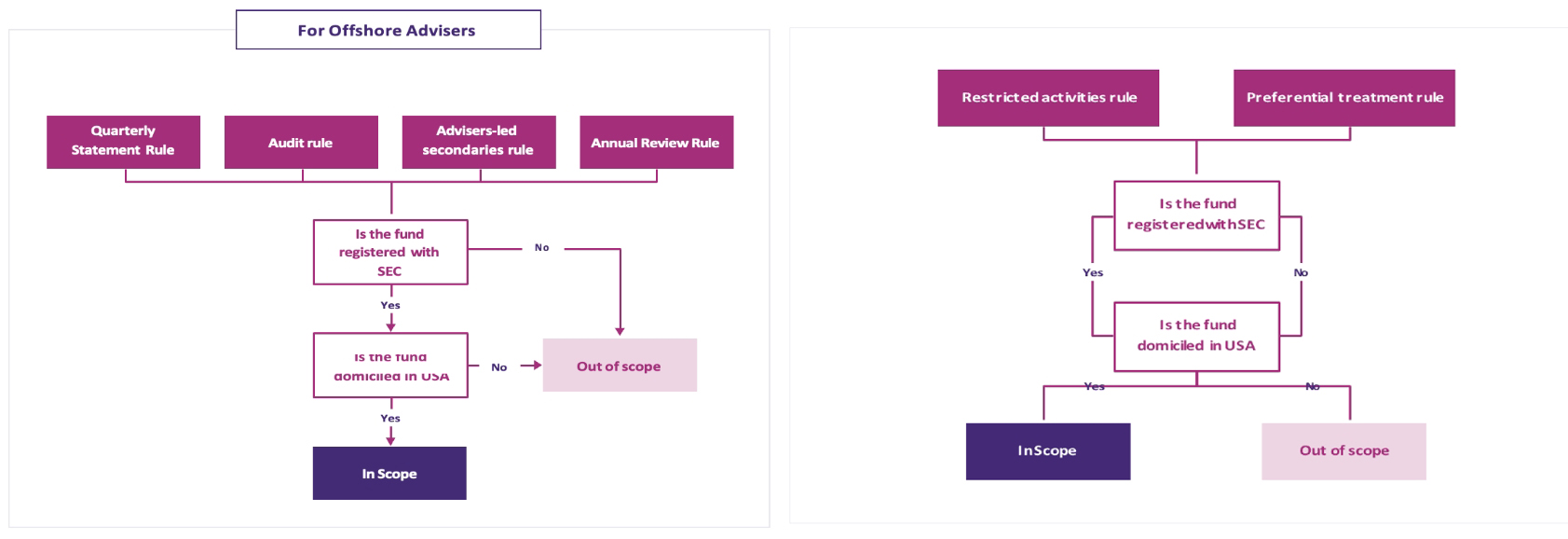

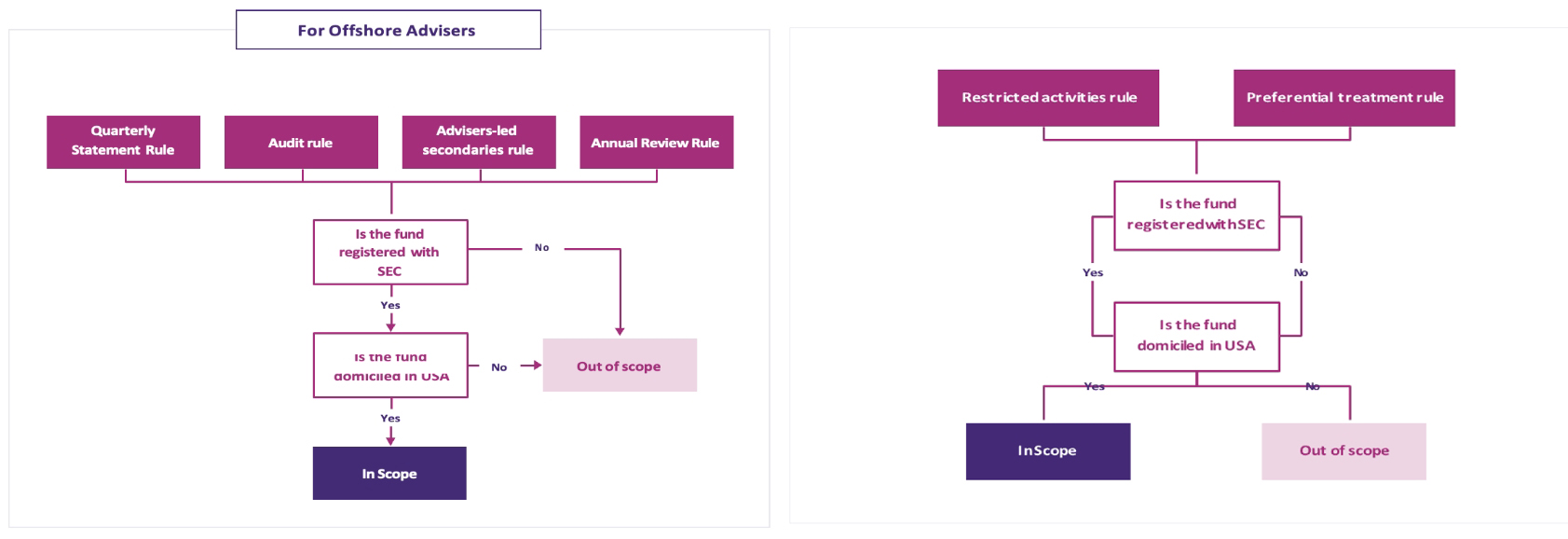

Scope of PFA Rules

Quarterly statement rule, Audit rule and Adviser-led secondaries rule are not applicable to non-US private funds of registered-offshore advisers, this is in

line with SEC’s historical approach of not applying substantive provisions of Advisers Act with respect to these funds/advisers. Further, the restricted

activities rule and preferential treatment rule are not applicable to unregistered offshore advisers for their non-US funds. Below flowcharts summarize, the

applicability of rules to offshore advisers:

With respect to the advisers to securitized asset funds (referred as “SAF Advisers”, by SEC), any of the final rules do not apply except for the annual review rule. The exemption from these rules is limited to the securitized asset funds managed by such advisers and not for the private funds.

Key Rules

A. Quarterly Statements Rule

Quarterly statement rule, Audit rule and Adviser-led secondaries rule are not applicable to non-US private funds of registered-offshore advisers, this is in line with SEC’s historical approach of not applying substantive provisions of Advisers Act with respect to these funds/advisers. Further, the restricted activities rule and preferential treatment rule are not applicable to unregistered offshore advisers for their non-US funds. Below flowcharts summarize, the applicability of rules to offshore advisers:

i. Fees and Expense Disclosure

The rule requires an investment adviser that is registered or required to be registered with the SEC to prepare and distribute quarterly statements for any private fund that it advises with certain information regarding the fund’s fees (such as advisory or sub-advisor fees and other similar fees) and expenses ( such as organizational, legal, administration, accounting, travel, taxes, etc.) and any compensation paid or allocated to the adviser or its related persons8 by the fund, as well as any compensation paid or allocated by the fund’s underlying portfolio investments.

(a) Private Fund-Level Disclosure

The quarterly statement rule will require private fund advisers to disclose the following information to investors in a tabular format:

A detailed accounting of all compensation, fees, and other amounts allocated or paid to the adviser or any of its related persons by the private fund (“adviser compensation”) during the reporting period;

A detailed accounting of all fees and expenses allocated to or paid by the private fund during the reporting period other than those listed in paragraph (1) above (“fund expenses”); and [Organizational, accounting, legal, administration, audit, tax, due diligence, and travel expenses]

The amount of any offsets or rebates carried forward during the reporting period to subsequent quarterly periods to reduce future payments or allocations to the adviser or its related persons.

(b) Portfolio Investment-Level Disclosure

The quarterly statement rule requires advisers to disclose a detailed accounting of all portfolio investment compensation allocated or paid by each covered portfolio investment during the reporting period in a single table.

(c) Calculations and Cross-References to Organizational and Offering Documents

This disclosure will generally require advisers to describe, among other things, the structure of, and the method used to determine, any

performance-based compensation set forth in the quarterly statement (such as the distribution waterfall, if applicable) and the criteria on which each type of compensation is based (e.g., whether such compensation is fixed, based on performance over a certain period, or based on the value of the fund’s assets).

ii. Performance Disclosures

In addition to providing information regarding fees and expenses, the rule requires advisers to include standardized fund performance information in each quarterly statement provided to fund investors.

Liquid Funds

To show performance based on net total return on an annual basis for the 10 fiscal years prior to the quarterly statement or since the fund’s inception, over one-, five-, and 10-fiscal year periods, and on a cumulative basis for the current

fiscal year as of the end of the most recent fiscal quarter.

Illiquid Funds

To show performance based on internal rates of return and multiples of invested capital

since inception and to present a statement of contributions and distributions.

iii. Preparation and Distribution of Quarterly Statements

– For Funds other than Fund of Funds (FoF) – 45 days for the first three quarters and 90 days for the fiscal year end

– For FoF – 75 days for the first three quarters and 120 days for the fiscal year end

Navigating Regulatory Transformation: Quarterly statement rule would involve changes in various operational aspects in terms of systems, technology, skills and scalability. We recommend advisers and administrators to review and implement the following system, technology and skill upgrades:

i. Review existing quarterly reporting template and incorporate changes as per new disclosures,

ii. Systems enhancements to ensure accurate and timely data collection for various funds and portfolio companies with respect to fees and

compensation paid to advisers. Additional efforts will be required by investment advisers dealing with FoF for data collections, validations and reporting for identification of covered portfolio companies.

iii. Automating data collection followed by fee disclosures and calculations for performance disclosures.

iv. Training the financial reporting team to understand the new reporting requirements. Preparation and review of internal proforma statements for a few reporting cycles could be beneficial before going live.

B. Audit Rule

The rule requires registered private fund advisers to cause the private funds they advise to undergo a financial statement audit that meets the requirements of the audit

provision in the Advisers Act custody rule (rule 206(4)-2)). The implication of this rule is that the adviser using surprise exam option (under Custody Rules) instead of annual audits, will now be required to undergo annual audits. If an adviser treats a Special Purpose Vehicle (SPV) as a separate client, this rule requires the audit of SPV as well. These audits will provide an important check on the adviser’s valuation of private fund assets and protect private fund investors against the misappropriation of fund assets. The funds are required to be audited (at least annually and upon liquidation) under US GAAS and the audited financial statements are required to be distributed within 120 days of the end of the reporting period.

In the case of fund of funds, this timeline is extended to 180 days, recognizing the practical challenges faced by such advisers, as the timely completion of their audits depends on the audit schedules of underlying funds.

Navigating Regulatory Transformation: Audit Rule would require advisers to undertake additional efforts and readiness steps to ensure

compliance. We recommend advisers to perform an audit readiness assessment and look-out for the key audit considerations:

i. Setting up process for review of investment valuation to ensure (a) accurate adjustments to fair value (including calibration and backtesting), corporate actions, capital activity, (b) cut-off procedures near the reporting date. Further, documenting valuation memos with covering key aspects including valuation assumptions or comparable valuations consideration is crucial. Any gaps in the valuation process can lead to audit delays and additional costs.

ii. Setting up review mechanism for complex calculations such as (a) realized and unrealized gain calculations, (b) carried interest or performance calculations,

iii. Documenting internal controls and processes related to investment process, valuation & pricing, asset custody, accounting policies.

iv. Setting up and maintaining effective data management systems to facilitate the audit process.

v. Hiring staff or experienced consultants for assistance before and during the annual audit process for timely closure of audits.

vi. Designing US GAAP compliant Policy Manual and financial statement templates

vii. Conducting a pre-audit review by management or consultants to identify and address potential issues before the actual audit could also be beneficial.

C. Adviser-Led Secondaries Rule

A transaction that provides fund investors with the choice of either selling all or a portion of their interests in a private fund or converting/exchanging them for new interests in another vehicle managed by the adviser or any of its affiliated entities is referred to as an ‘adviser-led secondary transaction’.

The reforms require a registered private fund adviser to obtain a fairness opinion or a valuation opinion in an adviser-led secondary transaction from an independent opinion provider. The rule also requires the adviser to prepare and distribute to the private fund’s investors a summary of any material business relationships the adviser has, or has

had within the prior two years, with the independent opinion provider. The fairness or valuation opinion along with the summary of material business relationship are required to be distributed to private investors before to the due date of the election form (i.e., before due date of the final election made by the investors) of the transaction.

This requirement is aimed to contain an adviser’s conflicts of interest in structuring and leading such transactions.

D. Restricted Activities Rule

The Final Rule restricts the private fund advisers from engaging in the following activities, unless they satisfy certain disclosure and, in some cases, consent requirements:

Restricted Activities

Charging or allocating to the private fund fees or expenses associated with an investigation of the adviser or its related persons by any governmental or regulatory authority;

Charging the private fund for any regulatory, examination, or compliance fees or expenses of the adviser or its related persons;

Reducing the amount of any adviser clawback by actual, potential, or hypothetical taxes applicable to the adviser, its related persons, or their respective owners or interest holders;

Borrowing money, securities, or other private fund assets, or receiving a loan or extension of credit, from a private fund client

Charging or allocating fees and expenses related to a portfolio investment on a non-pro rata basis when more than one private fund or other client advised by the adviser or its related persons have invested in the same portfolio company;

E. Preferential Treatment Rule

This rule prohibits all private fund advisers9, whether registered with the Commission or not, from:

01. Granting an investor in a private fund the ability to redeem its interest on terms that the adviser reasonably expects to have a material, negative effect

on other investors in that private fund

02. Providing information regarding portfolio holdings or exposures of a private fund or of a substantially similar pool of assets to any investor if the adviser reasonably expects that providing the information would have a material, negative effect on other investors in that private fund or in a substantially similar pool of assets.

The rule offers certain exceptions to the above treatment. The advisers are required to provide to current investors comprehensive, annual disclosure of all

preferential treatment provided by the adviser or its related persons since the last annual notice.

F. Annual Review Rule

The new rule amends the Advisers Act compliance rule10 to require all SEC-registered advisers to document the annual review of their compliance policies and procedures in writing. The rule does not dictate a specific format for the written documentation. The SEC has emphasized that advisers have the flexibility to choose a documentation style that aligns best with their business operations and to implement review procedures that they have found to be the most effective.

The SEC has also provided guidance regarding the timing of these reviews in relation to the Compliance Date. If an adviser initiates its annual review within the following 12 months after the compliance date, they are required to maintain written documentation of this review.

Furthermore, the SEC clarified that if an adviser’s review year partially overlaps with the Compliance Date, and they have already assessed the sufficiency of their policies and procedures in accordance with the compliance rule (Rule 206(4)-7) for that period preceding the Compliance Date, the new documentation requirement will not retroactively apply to that prior period.

G. Recordkeeping Rule

The new rule requires the private fund advisers to retain books and records related to the quarterly statements rule, the audit rule, the adviser-led secondaries rule, the restricted activities rule, and the preferential treatment rule.

Transition Period, Compliance Date and Grandfathering

Rule

Audit rule and Quarterly Statements Rule

Adviser-led secondaries rule, preferential treatment rule, and the restricted activities rule

Annual review rule