Purpose

The Financial Accounting Standards Board’s (FASB’s), ASC 205-20, Presentation of financial statements -Discontinued operations (‘ASC 205-20’) provides comprehensive guidance on the reporting and presentation of discontinued operations in financial statements. ASC 205-20 is a critical tool for financial professionals, preparers, auditors, and users of financial statements, offering detailed guidelines on the identification, measurement, and disclosure of discontinued operations.

This publication provides an overview of the requirements, implementation matters, and key considerations related to ASC 205-20. The technical views and accounting positions on the framework keep enhancing depending on carrying out further technical evaluations and their outcomes.

The need for a discussion on the topic of discontinued operations arises from changes in businesses consequent to the COVID-19 pandemic, changes due to focus on environmental considerations, complex accounting and reporting structures and revamping of businesses to requirements of changing times.

As the business environment continues to evolve, so does the need for robust financial reporting standards. Separate reporting of discontinued operations enables financial statements users to understand and evaluate the effects of a disposal transaction on the ongoing operations of an entity and ultimately contributing to a more informed decision-making process for investors, creditors, and other stakeholders.

Background

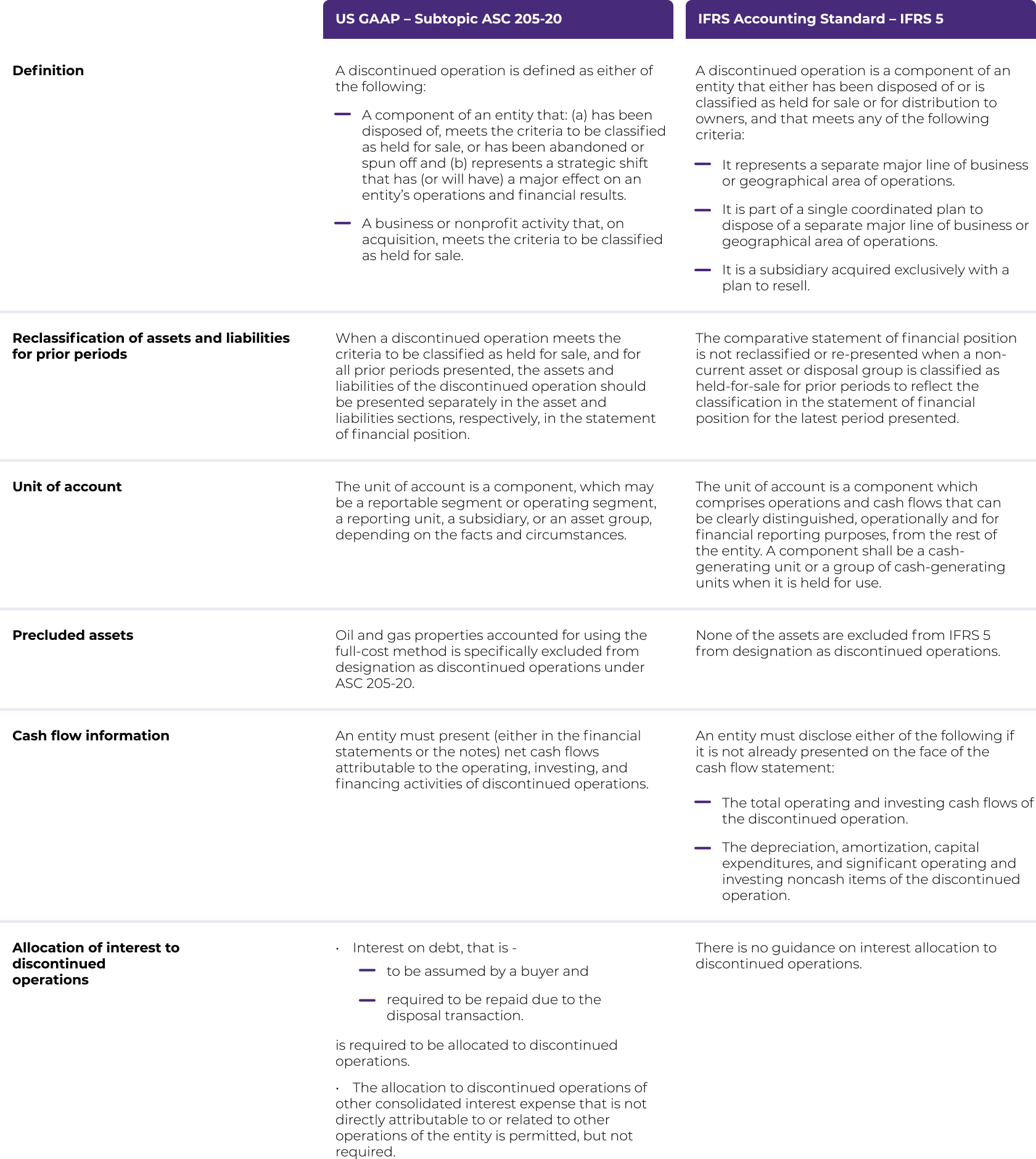

ASC 205, Presentation of Financial Statements, prescribes authoritative guidance for the presentation of financial statements for all the entities reporting under US GAAP accounting framework. Subtopic ASC 205-20 provides guidance on the presentation and disclosure of discontinued operations, including criteria for determining when the presentation of discontinued operations is appropriate.

It provides a 3-step process for determining when and how to report and disclose discontinued operations.

An entity may elect to provide certain information either on the face of the financial statements or in the notes. The disclosure requirements in Subtopic 205-20 for discontinued operations vary depending on the type of operation being disposed of:

An entity may elect to provide certain information either on the face of the financial statements or in the notes. The disclosure requirements in Subtopic 205-20 for discontinued operations vary depending on the type of operation being disposed of: