Purpose

In today’s era, most of entities especially the start-ups, are focusing on incentivizing employees and non-employee performance with equity or equity linked awards (including stock options, restricted stock, restricted stock units (RSUs), stock appreciation rights (SARs), and other equity-based instruments) to align their compensation with an entity’s operating performance and provide those holders with the opportunity to participate in future profits and/or equity appreciation of the entity.

ASC 718 addresses the financial accounting and reporting for a stock-based compensation transaction. The guidance in ASC 718, applies to various types of equity-based awards companies use to compensate their employees.

This publication provides an overview of the key accounting considerations and implementation matters relating to ASC 718. The technical views and accounting positions on the framework are constantly evolving.

We sincerely hope you find this quick reference guide informative in identifying and evaluating the issues related to Stock-based compensation. We will be happy to participate in any discussions required to clarify our views, which are enclosed in the attached publication. We look forward to hearing from you.

Background

ASC 718 provides accounting guidance on share-based payment awards. It requires entities to use a fair-value-based measure when recognizing the cost associated with these awards in the financial statements. The primary objective of ASC 718 is for entities to recognize the cost of that compensation in their financial statements as the goods or services associated with the awards are provided.

Applicability of principles of ASC 718 is principally governed by the basis of award settlement. For a awards to be within the scope of ASC 718, terms of arrangement should require settlement in the entity’s equity or settlement is based, at least in part, on the price of the entity’s equity. An entity’s conclusion related to whether an award is within the scope of ASC 718 significantly affects the amount of compensation cost recognized and when such cost is recognized in the financial statements.

These days, some of the non-public entities, such as limited partnerships, limited liability companies, or similar pass-through entities, grant special awards in the form of profits interests, for example, profits interest, which may entitle the interest holder to a portion of any distributions made, once senior interest holders obtain a specified return. Because profits interest holders only participate in future profits and/or equity appreciation and have no rights to the existing net assets of the partnership, it becomes difficult to determine whether a profits interest award should be accounted for as a share-based payment arrangement (Topic 718) or similar to a cash bonus or profit-sharing arrangement (Topic 710, Compensation—General, or other Topics).

An award that has the characteristics of an equity interest represents a substantive class of equity and should be accounted for under ASC 718; however, an award that is, in substance, a performance bonus or a profit-sharing arrangement would be accounted for in accordance with other guidance as applicable to employee arrangement such as ASC 710. In other words, profits interest awards may be akin to equity interests or profit sharing/bonus arrangements. In the absence of any authoritative guidance, judgment is required to make that assessment, which in practice, has resulted in diverse accounting for these awards.

Summary of Topic

Scope

ASC 718-10-15-3 provides guidance for the scope applicability of ASC 718 to stock compensation awards. As per the principles of ASC 718-10-15-3, if it is determined that an award (or the underlying security) has predominantly equity characteristics (even if junior to other classes of equity interests), it is subject to the scope of the ASC 718. In other words, if payment under the arrangement must be settled in or based, at least in part, on the price of the entity’s shares or other equity instruments, the arrangement is in the scope of ASC 718.

ASC 718 applies to all transactions with employees or non-employees in which an entity receives goods or services to be used or consumed in the entity’s own operations in exchange for share-based instruments. Common examples of share-based payment awards include stock options, SARs, restricted stock, and RSUs. Such awards also include liabilities incurred that (1) are indexed, in part, to the price of the entity’s shares or other equity instruments or (2) require or may require settlement by issuing the entity’s equity shares or other equity instruments.

The following provides an indicative list of the factors that may be considered to determine whether an arrangement is a share-based arrangement that should be accounted for under ASC Topic 718 or not. The list is not all-inclusive-:

To read this section in detail, download the pdf.

Awards Granted- Employees Vs. Non-Employees

ASC 718 provides accounting principles related to recognition and measurement of Share-based payments granted to employees and non-employees. The guidance on non-employee awards is largely aligned with that on employee awards are subject to the following exceptions:

Attribution of compensation cost — The compensation cost related to Share-based payments to employees is recognized over the service period, however in respect to share-based payments to non-employees ASC 718 does not prescribe the period(s) or the manner (i.e., capitalize or expense) in which nonemployee share-based payments will be recognized therefore in case of non-employees the costs are recognized in the same period and in the same manner in which the entity would, if it had paid cash for those goods or services.

Measurement principles — Share-based payments to employees are measured based on the expected term of the award. In contrast, share-based payments to non-employees may be measured based on the expected term, or the entity can elect to use the contractual term as the expected term on an award-by-award basis.

Therefore, determining whether the grantee is an employee or non-employee is critical for accounting for the awards.

Classification of Awards

The awards classified as within the scope of ASC 718 need to be further assessed as to whether features of the award result in the “Liability” or “Equity” classification. Key factors, which should be considered for such classification assessment include:

- The legal form of the instrument (to be classified as equity, it must be considered legal equity of the partnership or LLC).

- Participation features such as voting rights, distribution rights, and liquidation rights (i.e., to be classified as equity, the instrument must participate in

- the residual returns of the entity’s net assets in a manner consistent with equity ownership).

- Transferability of the instrument.

- Retention of vested interests upon termination of employment or when a nonemployee ceases to provide goods or services (liability classification is

- likely when vested interests are not retained upon termination).

- The settlement and repurchase features.

The classification assessment determines how the awards are accounted for and reported in the financial statements.

To read this section in detail, download the pdf.

Modification of Awards

Modifying share-based payment awards involves changes to the terms or conditions of existing awards. These changes can affect the recognition and measurement of compensation costs, potentially altering total expenses. Modification accounting should be applied by an entity when there is a modification of an award unless there is no change in the following terms because of modification:

- Fair value (or calculated value or intrinsic value, for entities that use either of those methods);

- Vesting conditions of the award; and

- The classification as either a liability or equity instrument.

To read this section in detail, download the pdf.

Profits interest awards

Certain entities provide employees or non-employees with profits interest awards to align compensation with an entity’s operating performance and allow those holders to participate in future profits and/or equity appreciation of the entity. The term profits interest is not defined in GAAP. Still, it differentiates those interests from capital interests held by investors that provide those holders with rights to the existing net assets in a partnership or similar entity (for instance, a limited liability company [LLC]). Because profits interest holders only participate in future profits and/or equity appreciation and have no rights to the existing net assets of the partnership, it becomes difficult to determine whether a profits interest award should be accounted for as a share-based payment arrangement (Topic 718) or similar to a cash bonus or profit-sharing arrangement (Topic 710, Compensation—General, or other Topics).

Correct accounting depends upon the correct classification of awards. While these awards’ legal and economic forms can vary, they should be accounted for based on their substance. An award that has the characteristics of an equity interest represents a substantive class of equity and should be accounted for under ASC 718; however, an award that is, in substance, a performance bonus or a profit-sharing arrangement would be accounted for in accordance with other guidance as applicable to employee arrangement such as ASC 710. In other words, profits interest awards may be akin to equity interests or profit sharing/bonus arrangements. In the absence of any authoritative guidance, judgment is required to make that assessment, which in practice, has resulted in diverse accounting for these awards.

To read this section in detail, download the pdf.

Group Awards Accounting

Parent companies often grant share-based payment awards (such as stock options or restricted stock) to employees or non-employees of a subsidiary. Similarly, a subsidiary may also grant share-based payments to employees or non-employees of the parent company or of other subsidiaries within the consolidated group. Accounting for share-based payment awards exchanged within a group of companies—such as between a parent and its subsidiaries or among subsidiaries in a consolidated group—can be a complex issue in practice. Many practitioners struggle with this, especially regarding recognizing the expense and handling intercompany eliminations.

When stock-based awards, such as stock options or restricted stock units (RSUs), are issued, the treatment for a holding company and its subsidiaries will depend on whether the awards are granted by the parent or the subsidiary and how those expenses are reflected in the consolidated financial statements.

To read this section in detail, download the pdf.

Business Combination

In connection with a business combination, the acquirer may agree to assume existing stock-based compensation arrangements with employees of the acquiree or may establish new stock-based compensation arrangements to compensate those employees for post-combination services. These arrangements may involve cash payments to the employees or the exchange (or settlement) of stockbased awards. These replacement awards, in many cases, include the same terms and conditions as the original awards and are intended to keep the employees of the acquiree “whole” (i.e., preserve the value of the original awards at the acquisition date) after the acquisition. In other situations, the acquirer may change the terms of the stock-based awards, often to provide an incentive to key employees to remain with the combined entity.

In connection with a business combination, the acquirer may agree to assume existing stock-based compensation arrangements with employees of the acquiree or may establish new stock-based compensation arrangements to compensate those employees for post-combination services. These arrangements may involve cash payments to the employees or the exchange (or settlement) of stockbased awards. These replacement awards, in many cases, include the same terms and conditions as the original awards and are intended to keep the employees of the acquiree “whole” (i.e., preserve the value of the original awards at the acquisition date) after the acquisition. In other situations, the acquirer may change the terms of the stock-based awards, often to provide an incentive to key employees to remain with the combined entity.

ASC 718 does not provide specific guidance on accounting for awards exchanged in a business combination. However, ASC 805, Business Combinations, does include specific guidance on this subject.

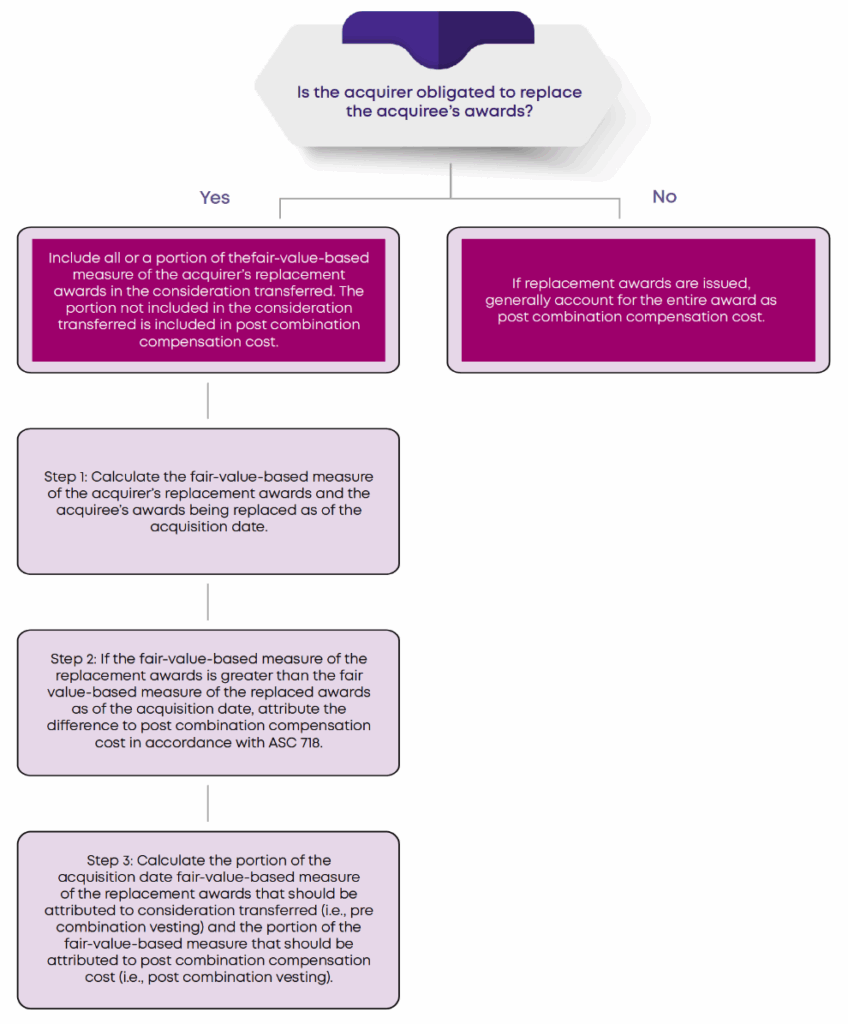

ASC 805-30-30-9 notes that the acquirer is obligated to replace the acquiree’s share-based payment awards “if the acquiree or its grantees have the ability to enforce replacement.” It further indicates that the acquirer is obligated to replace the awards if replacement is required by (1) the terms of the acquisition agreement, (2) the terms of the acquiree’s awards, or (3) applicable laws or regulations.

Replacement of Acquiree Awards:

- When an acquirer replaces the share-based payment awards of the acquiree, it is essential to determine whether these awards are part of the consideration for the acquisition of business to be recognized as a business combination transaction or it relate to a business combination event to be recognized as future compensation cost in post business combination financial statements.

- Replacement awards are measured at their fair value at the acquisition date. The portion attributable to pre-combination service is accounted for as part of the purchase price (equity), while the portion attributable to future service is recognized as post-combination compensation expense over the requisite service period.

To read this section in detail, download the pdf.

Key issues/Considerations

Issue 1: “Spring-Loaded” Share-Based Compensation Transactions and Valuation Adjustments

“Spring-loaded” share-based compensation refers to a scenario where a company grants stock options or other equity-based compensation to employees right before a material event is expected to cause a significant increase in the company’s stock price, such as a positive earnings announcement, acquisition, or other market-moving event.

The SEC has noted instances where companies grant share-based compensation while in possession of positive material non-public information. In response, the SEC issued Staff Accounting Bulletin: 120 (SAB 120) to provide interpretive guidance for public companies engaged in share-based payment transactions under such circumstances. SAB 120 offers additional guidance for estimating the fair value of share-based payment transactions in accordance with Topic 718, focusing on determining the current price of the underlying share and estimating the expected volatility of the share price over the expected term when material non-public information is involved.

According to ASC 718-10-30-6, companies must estimate the fair value of the equity instrument as of the grant date. In the case of spring-loaded stock options, the market price of the underlying shares may not reflect the impact of material non-public information. Consequently, the fair value of such options on the grant date would not capture the effect of a potential positive price movement in the underlying shares.

Management is typically required to develop estimates related to (i) the volatility of the underlying share price, (ii) the expected term of the option, and (iii) the determination of the current price of the underlying share. The SEC staff emphasizes that adjustments to the market price and volatility of the underlying share involve significant company management judgment.

The SEC staff also expects management to disclose its accounting policies regarding adjustments to the closing price, the method used to determine the adjustment amount, and any significant assumptions applied in making such adjustments.

Facts: Company D, a public entity, entered into a significant contract with a customer after market close and subsequently awarded non-routine share options to its executives. These awards, approved by the Board in anticipation of the contract, were granted before the next trading day when the share price was expected to rise significantly due to the announcement. Company D’s accounting policy consistently uses the closing share price on the grant date to estimate the fair value of share options. Should Company D adjust the closing share price to determine the current share price for estimating the fair value of the share options?

Analysis: The SEC staff advises that before granting such awards, Company D should evaluate its alignment with internal policies, shareholder-approved compensation plans, governance standards, and legal requirements. Additionally, the staff emphasizes the need for robust corporate governance and effective financial reporting controls. In this scenario, using the unadjusted closing share price would not meet the fair value measurement objective of ASC Topic 718, as it would not provide an unbiased estimate reflecting marketplace conditions at the grant time. An adjustment to the closing price is necessary to account for the impact of the material contract.

Issue 2: Determination of Grant date

Determining the grant date is a critical issue in accounting for share-based compensation. It affects when and how compensation expense is recognized, the calculation of fair value, and the overall accuracy of financial reporting.

The grant date is determined when the grantor and grantee mutually understand the award’s key terms and conditions and obtain all necessary approvals (e.g., board or shareholder). The grant date reflects the point at which the grantee begins to benefit from or be affected by changes in the grantor’s equity price. Key considerations include Approval Requirements, Clarity of Terms, Eligibility, and Uncertainty in Terms.

To read this section in detail, download the pdf.

Issue 3: Clawback Features

A clawback feature requires the grantee to return share options, shares, or realized gains under specific conditions, often without compensation or adjusted for amounts paid. These provisions are typically triggered upon departure, particularly to discourage employees from joining competitors. Clawback features are not factored into the grant-date fair value of the award; instead, they are accounted for only if the contingent event occurs. However, such features can influence the grantee’s exercise behavior, potentially affecting valuation assumptions like the expected term. For instance, awards with reload features might have shorter expected terms, leading to a lower grant-date fair value. Entities should evaluate the impact of clawback or reload features on relevant valuation assumptions when determining fair value.

Clawback features are accounted for if and when the contingent event occurs by recognizing the consideration received from the former grantee in the appropriate balance sheet account (treasury stock if the entity receives its shares back) and a credit in the income statement. The amount of consideration recognized is equal to the lesser of:

- recognized compensation cost related to the share-based payment arrangement that contains the contingent feature, or

- the fair value of the consideration received.

To read this section in detail, download the pdf.

Comparison with IFRS

ASC 718, Compensation—Stock Compensation under U.S. Generally Accepted Accounting Principles (GAAP), and IFRS 2, Share-based payment under International Financial Reporting Standards (IFRS), both the standards provide guidance on Stock-based compensation accounting. Both accounting frameworks share the same principles-based approach and are largely converged. However, there are some key differences in the application of those principles.

To read this section in detail, download the pdf.