EU Sustainability Omnibus Overview

On 26 February 2025, the European Commission released an Omnibus proposal that consolidates and simplifies existing sustainability regulations. To streamline and simplify reporting requirements for businesses, it combines the CSRD and CSDDD.

Corporate Sustainability Reporting Directive (CSRD)

Reporting on environmental, social, and governance topics that are material from both finance and impact perspectives.

The Omnibus would reduce the scope and introduce the following key changes:

- Applicability: Simplifying of thresholds for large companies to 1000 employees and either €50M turnover or €25M balance sheet; reduces number of in-scope firms by 80 percent

- Non-EU parent companies: Reporting at group level from 2028 when the group has turnover exceeding €450M generated in the EU and at least one large EU subsidiary or EU branch with more than €50M turnover

- Value Chain Cap: Limiting engagement to value chain partners with >1000 EEs, lowering number of partners from which firms must request data

- Assurance: Removal of authority to increase CSRD assurance requirement from limited to reasonable level; only limited assurance is required

- Standards: Simplification of ESRS forthcoming within six months of the Omnibus proposals entering into force; no sector-specific standards

- Deadlines: Entry into application postponed by 2 years for large companies

EU Taxonomy

A classification system for environmentally sustainable economic activities in the EU.

The Omnibus would reduce the scope and introduce the following key changes:

- Opt-In Regime: Introduces voluntary Taxonomy-aligned reporting for companies with over 1000 employees and net turnover below €450M, designed to assist such firms in unlocking sustainable finance

- Datapoints: Consultation drafts forthcoming will reduce datapoint needs from reporting templates by around 70 percent

- Materiality Threshold: Companies are also exempt from disclosing Taxonomy alignment for which less than 10 percent eligible activities are financially material; this further reduces reporting burden on companies

- Indicators: Amends main KPIs for financial institutions, such as green asset ratio for banks; proposes alternative options for the ‘Do No Significant Harm’ (DNSH) criteria on pollution prevention and control

Carbon Border Adjustment Mechanism

A trade policy measure by the EU to price carbon emissions from goods entering the EU.

The Omnibus would reduce the scope and introduce the following key changes:

- De Minimis Thresholds: Introduces mass-based exemption threshold for importing companies of 50 metric tons in cumulative annual emissions; this exempts approximately 90 percent of importers, while still covering 99 percent of emissions

- Simplification of Obligations: Facilitates importers’ compliance with rules of CBAM, including simplification of authorization of declarants, emissions calculation, and management of financial liability

- Additional Measures: Strengthening of rules to avoid circumvention or abuse to ensure that the CBAM remains effective; the CBAM will be strengthened and extended to other EU Emissions Trading System sectors, downstream goods, by a new legislative proposal in early 2026

Corporate Sustainability Reporting Directive (CSRD) overview

The Corporate Sustainability Reporting Directive (CSRD) is designed to enhance and standardize sustainability reporting for companies operating in the EU, mandating companies to disclose detailed corporate sustainability information – including data on environmental impact (e.g., carbon emissions, climate-related risks), social factors (e.g., diversity, labor conditions), and governance topics (e.g., ethics, board composition).

The Omnibus package would reduce the scope of the CSRD notably, however, the core aspects and standards of the Directive remain the same.

The European Sustainability Reporting Standards (ESRS) are the supporting framework supporting the CSRD. The ESRS comprises of 12 standards, which may themselves be revised and simplified within the coming six months after the entry into force of the Omnibus.

The European Commission intends to simplify the ESRS by reducing the number of mandatory datapoints, removing those deemed least important. It intends to do so by prioritizing quantitative datapoints over narrative disclosures, distinguishing between mandatory and voluntary datapoints without undermining interoperability with global reporting standards and while preserving application of the double materiality principle.

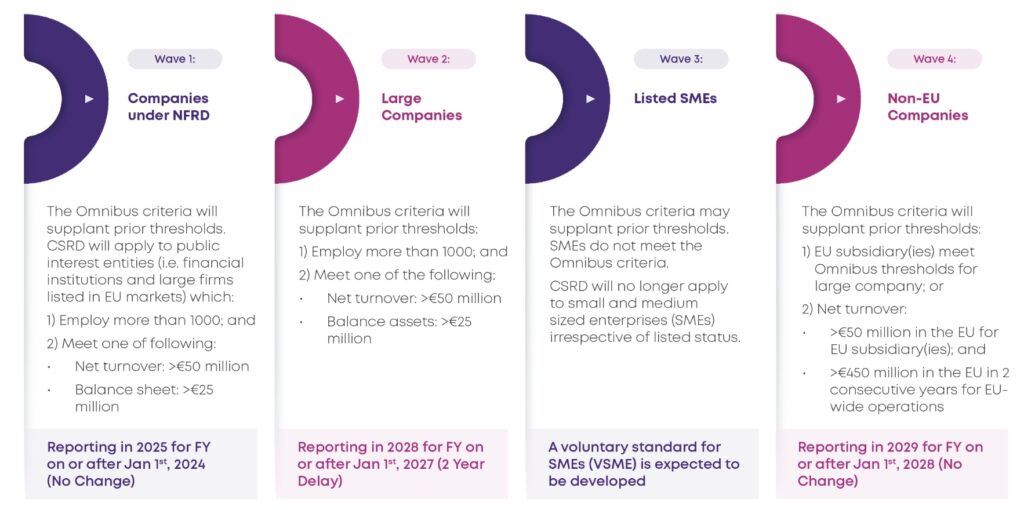

CSRD Applicability Thresholds and Timelines

The proposed Omnibus package would amend the CSRD by raising applicability thresholds to include EU firms with over 1,000 employees and meeting certain financial criteria, and non-EU firms with in-scope EU subsidiaries and/or over €450 million in EU turnover. This reduces the scope of the CSRD and aligns it more closely with the CSDDD. The entry into application for certain groups of in-scope entities have also been amended by the Omnibus. The following table summarizes the new thresholds and entry into applications for CSRD companies as proposed by the Omnibus.

Companies should evaluate the applicability criteria for their European as well as non-EU subsidiaries based on the guidance and timelines above considering their financial year-end cycle. Companies should also consider the optimal first-time disclosure exemptions.

CSRD Applicability for Non-EU Companies

Although the Omnibus directive raises the CSRD applicability for non-EU companies that meet certain employee and financial criteria, many non-EU-based multinationals will still be subject to the CSRD. If the EU branches of your international company meet the criteria for a large EU undertaking under the CSRD, for example, you would need to prepare CSRD disclosures at the subsidiary(ies) level starting 2028 for the fiscal year beginning Jan 1, 2027.

Double Materiality Assessment Overview

The CSRD establishes that sustainability reporting shall be based on the principle of double materiality. This means that companies shall consider both impact materiality and financial materiality when identifying the material matters, which is the basis for the determination of the material information to be disclosed. Double materiality has been retained in the Omnibus proposal.

A double materiality assessment (DMA) is a crucial first step in the process of adopting the CSRD requirements.