INTRODUCTION TO IFRS 18

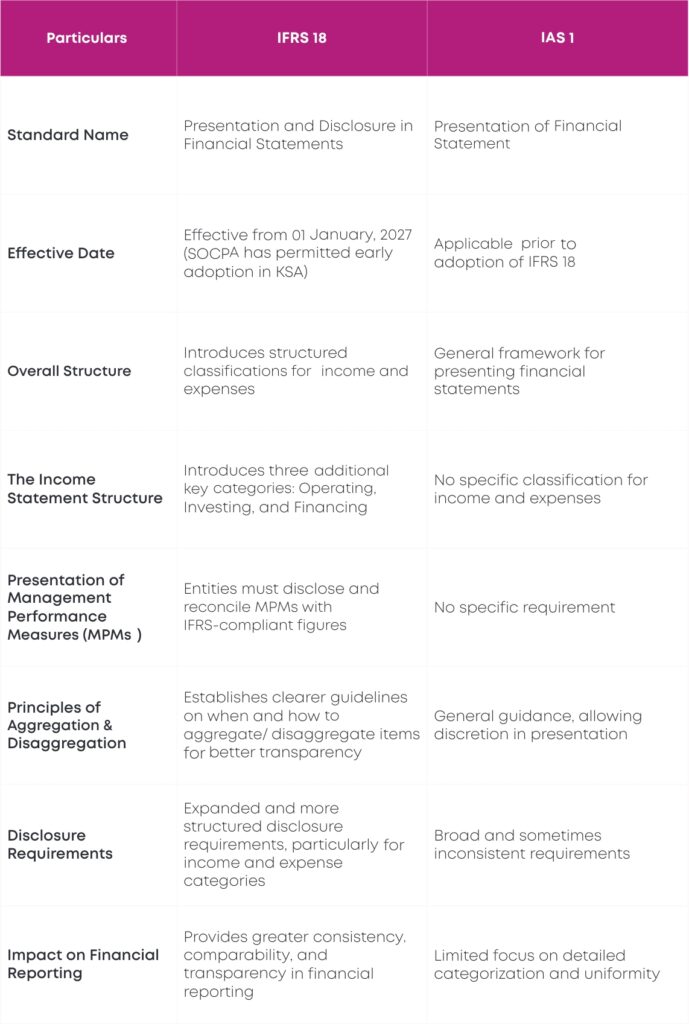

IFRS 18 is a newly issued standard by the IASB, replacing IAS 1 Presentation of Financial Statements (“IAS 1”). It introduces significant changes to the structure and presentation of financial statements, aiming to enhance transparency, consistency, and comparability globally. Whilst IFRS 18 is applicable from annual periods commencing 01 January 2027, SOCPA has permitted organisations to early adopt the said standard voluntarily in KSA.

The implementation of IFRS 18 will not only increase investor confidence but also improve the entity’s reporting process and controls. The revised financial statements will present standardized income statements with more disaggregated information and add management-defined performance measures as part of the financial statements. This will lead to more transparency, clarity and comparability between industries globally.

IFRS 18 has laid down the following concepts to standardise the presentation and disclosure of the income statement:

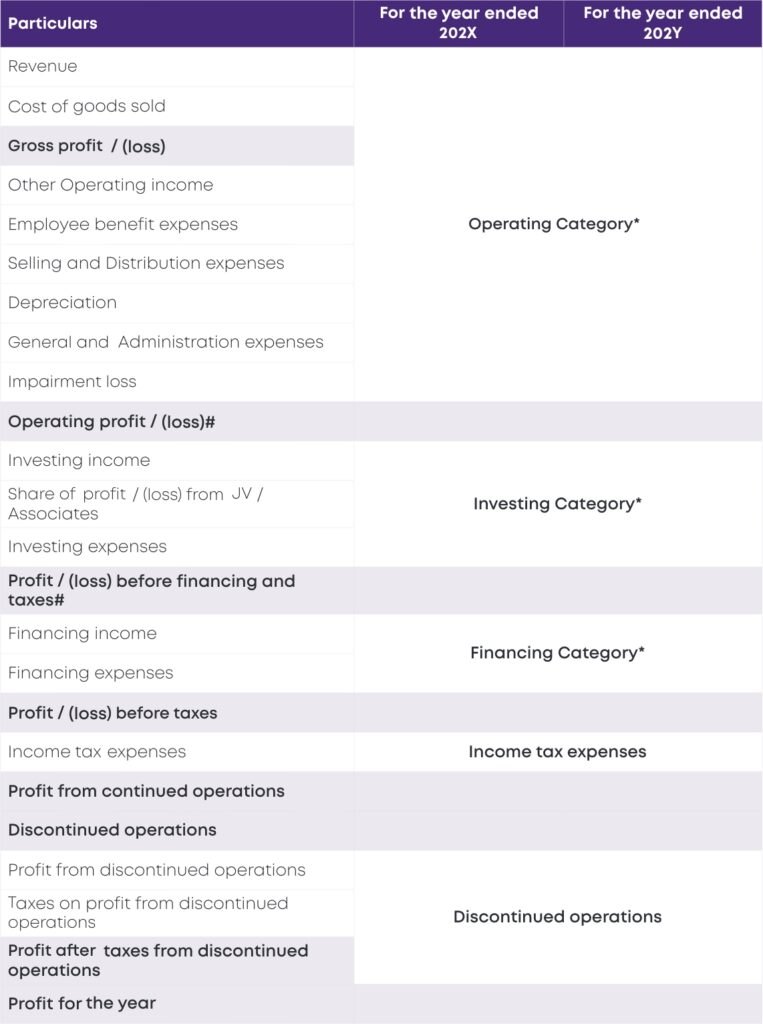

- Classification of all income and expenses into 5 categories (i.e. Operating, Investing, Financing, Taxes, Discontinued operations).

- New subtotals on the face of income statement (i.e., Operating Profit, Profit/ (loss) before financing and taxes)

- Management-defined Performance Measures – Metrices reported by management for internal or external communication will be part of the Income Statement / disclosures.

- Aggregation v. Disaggregation – Assets / Liabilities / Income / Expenses to be segregated basis function or nature or combination of both.

Other disclosures required by the specific IFRS Standard will continue as before.

Key Concepts introduced in IFRS 18

Under ASC 606, revenue is recognized when control of goods or services is transferred to the customer at an amount reflecting the consideration to which the entity expects to be entitled to in exchange for those goods or services. The Standard introduces a comprehensive five-step model for revenue recognition, summarized as follows:

Classification of Income and Expenses

Exception for Specified Main Business Activities

Segregation of Operating Expenses in the Income Statement

New Subtotals Introduced on the Income Statement

Management-Defined Performance Measures (“MPMs”)

Aggregation and Disaggregation

Foreign exchange (“Forex”) gain/ loss

Key Enhancements in IFRS 18: In-Depth Analysis

In this section, we delve into some of the most significant and critical changes introduced by IFRS 18, focusing on concepts that require deeper understanding and practical application. While the new classifications enhance financial reporting, certain aspects demand closer attention due to their complexity and impact on financial statements.

We will specifically explore the Specified Main Business Activities, Management-Defined Performance Measures (MPMs), and Aggregation and Disaggregation of information. These elements introduce new reporting requirements that influence how financial data is presented, ensuring greater transparency and comparability. To provide clarity, we will also illustrate each concept with a detailed case study, helping readers understand their practical implications.

- Specified Main Business Activities

IFRS 18 introduces new requirements for entities having specified main business activities, i.e., those entities that are primarily engaged in investing in assets or providing financing to customers. Unlike other entities, these businesses must classify certain investments and financing income and expenses under the Operating category, reflecting their core revenue-generating activities. This requirement ensures that financial statements accurately represent the entity’s primary business operations.

- Exceptions to the Classification Rules

- Standalone vs Group Level Assessment

- Case Study: Classification Challenges in a Diversified Business

- IFRS 18 Assessment for the Standalone Financial Statements

- IFRS 18 Assessment for the Consolidated Financial Statements

- Additional Considerations and Changes in Classification

- Management-defined performance measures (MPMs)

- Case Study: Adjusted EBITDA (before ESOP and after Rental outflow)

- Disclosure Considerations in Financial Statements

- Aggregation and Disaggregation

- Principle of Aggregation and Disaggregation

- Case Study: Aggregation and Disaggregation in Financial Statements

The Income Statement – Revised Presentation

Comparison of IFRS 18 and IAS 1

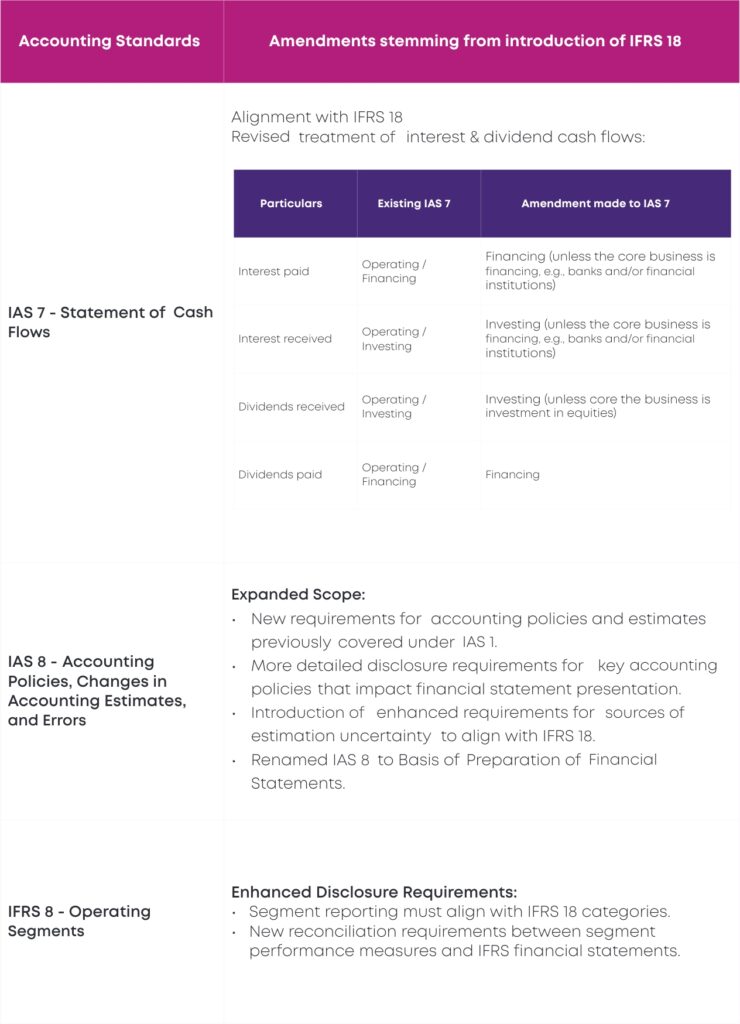

Comparison of IFRS 18 and IAS 1Amendments to Other Accounting Standard

Transition to IFRS 18

The transition to IFRS 18 is a critical step for companies aiming to align with global financial reporting standards. Compared to previous Standards, IFRS 18 places a greater emphasis on transparency, requiring businesses to provide more detailed and comprehensive financial disclosures. This shift offers organizations the opportunity to enhance the quality, consistency, and comparability of their financial reporting. However, it also presents significant challenges, including the need for system upgrades, better data management, and stronger internal controls.

For businesses with complex operations, such as subsidiaries, joint ventures, or multiple revenue streams gathering, organizing, and reporting the required data can be overwhelming. Existing accounting systems may not be equipped to oversee the level of detail needed by IFRS 18, necessitating costly system upgrades or the implementation of new financial reporting tools.

Equally important is the impact on internal controls. With the increased disclosure requirements, companies must reassess their control frameworks to ensure that all data is accurately captured and reported. Strengthening internal controls involves revising processes, redefining roles within finance teams, and enhancing communication across departments to ensure data accuracy.

Employee training also plays a crucial role in ensuring a smooth transition. Finance teams must be well-versed in IFRS 18’s specific requirements to avoid errors and ensure compliance. Tailored training programs that cover both the technical aspects of the standard and practical steps for preparing compliant financial statements will help organizations manage the transition effectively.

When implementing IFRS 18, entities must produce a reconciliation for each line item in the income statement for the comparative period, outlining the adjustments from the amounts previously reported under IAS 1 to the restated amounts under IFRS 18. When it is impracticable to reclassify comparative amounts, an entity shall disclose the reason for not reclassifying the amounts; and the nature of the adjustments that would have been made if the amounts had been reclassified.