KNOWLEDGE CORNER

SEBI’s New Guidelines on Voluntary Proforma Financial Disclosures: Enhancing Transparency in Public and Qualified Institutional Placements

The Securities and Exchange Board of India (SEBI) has recently approved a set of recommendations to improve the transparency and reliability of financial disclosures in public offerings, rights issues, and Qualified Institutions Placements (QIPs). SEBI’s new guidelines allow issuers greater flexibility in disclosing proforma financial statements and financial information related to recent acquisitions or divestitures. These changes are designed to give investors a clearer picture of a company’s financial health, particularly in cases where acquisitions or divestments may impact financial results. Here’s a detailed look at SEBI’s new approach to voluntary proforma financial disclosures and how it benefits investors.

Requirements before amendment

Under the SEBI (ICDR) Regulations, issuers undertaking a public or rights issue must include proforma financial statements for any “material” acquisition or disposal that occurs after the latest reported financial period but before the offer document’s filing date. These proforma statements must cover the latest completed financial year and stub period as applicable. They are prepared according to the guidance note issued by Institute of Chartered Accountants of India (ICAI) and certified by either the statutory auditor or an independent chartered accountant.

However, there are no enabling regulations for the voluntarily inclusion of the proforma financial statements for acquisition or divestment already undertaken or proposed to be undertaken from issue proceeds in case of public issue, rights issue and QIPs.

Recognizing these limitations, the Expert Committee for facilitating ease of doing business and harmonization of the provisions of ICDR and LODR Regulations recommended a set of voluntary disclosure options to SEBI, designed to give issuers the flexibility to present a more comprehensive view of their financials. Key recommendations include –

| in public issues and rights issues (both fast track and otherwise), in addition to the existing requirements, the issuer should be permitted to voluntarily include proforma financial statements for such additional fiscal periods as it deems necessary, including, even if the acquisition or divestment was undertaken before the completion of the latest period(s) for which financial statements are disclosed, especially if the full year impact of the acquisition or divestment is not reflected in the latest period(s) financial statements; |

| the issuer should be permitted to voluntarily disclose financial statements of the subsidiaries/ businesses acquired or divested, provided such financial statements are certified by the auditor (of the business or subsidiary acquired or divested) or an independent chartered accountant, either of whom should be peer reviewed; |

| in QIPs, the issuer should be permitted to voluntarily include proforma financial statements, provided these are certified by the statutory auditor or an independent chartered accountant, either of whom should be peer reviewed; and |

| Further, it was also recommended that if the proceeds of the issue are proposed to be used for the acquisition of one more businesses or entities in a public issue, rights issue or a QIP, an issuer should also be permitted to voluntarily disclose proforma financials (on a consolidated basis) to disclose the impact of such acquisition. The proforma financial statements should be certified by the statutory auditor or an independent chartered accountant, either of whom should be peer reviewed. |

Illustrating the Importance of Proforma Financials for Investors

To understand how these changes benefit investors, consider two illustrative scenarios involving companies with recent acquisitions:

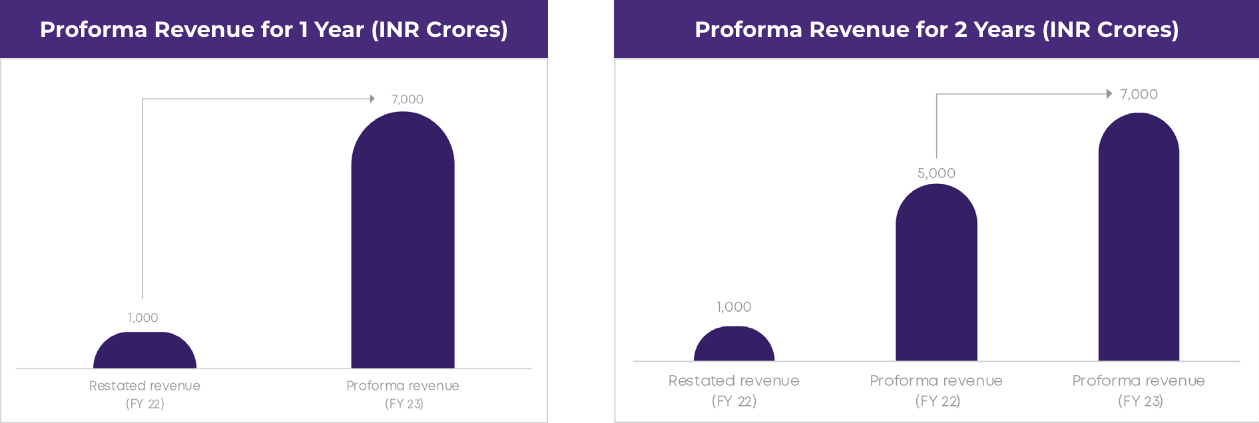

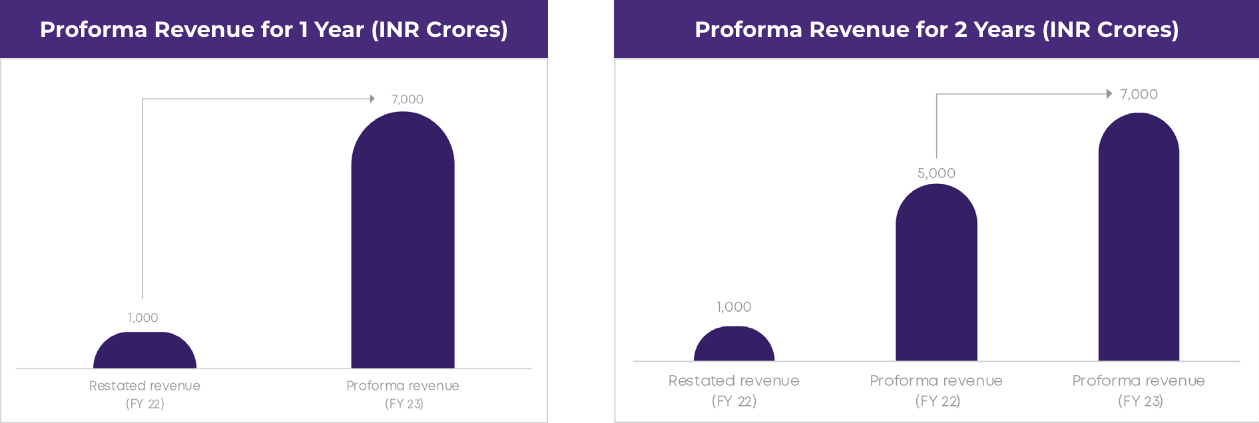

Scenario 1

A company acquires another entity after the close of FY 2023 (post-March 31, 2023) and prepares a draft red herring prospectus (DRHP) including restated consolidated financials for FY 2023, FY 2022, and FY 2021. Without proforma financials for prior periods, investors may see an abrupt jump in financial metrics such as revenue when comparing FY 2022 to FY 2023, lacking context for growth continuity. With comparative proforma financials for both FY 2023 and FY 2022, investors can evaluate a normalized growth trend, gaining insights into the acquisition’s full impact on revenue and profitability.

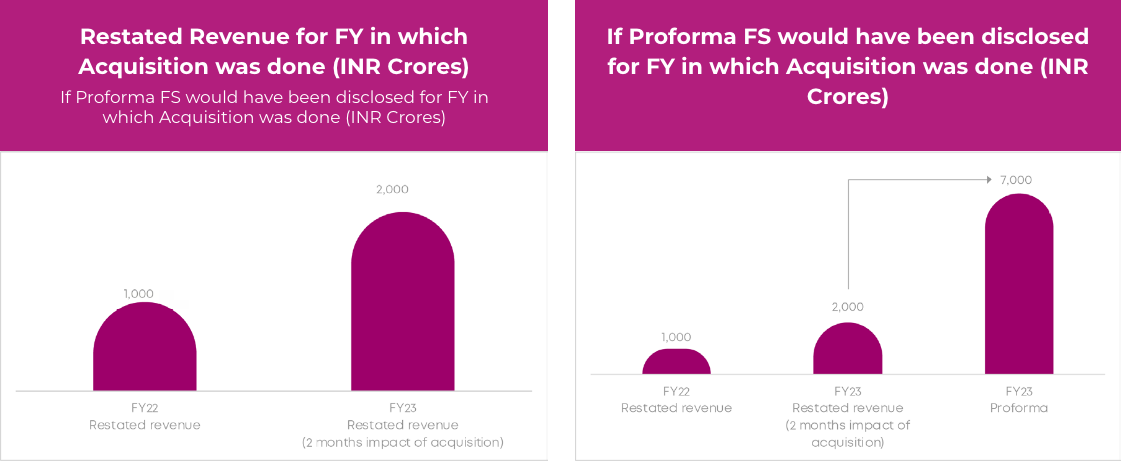

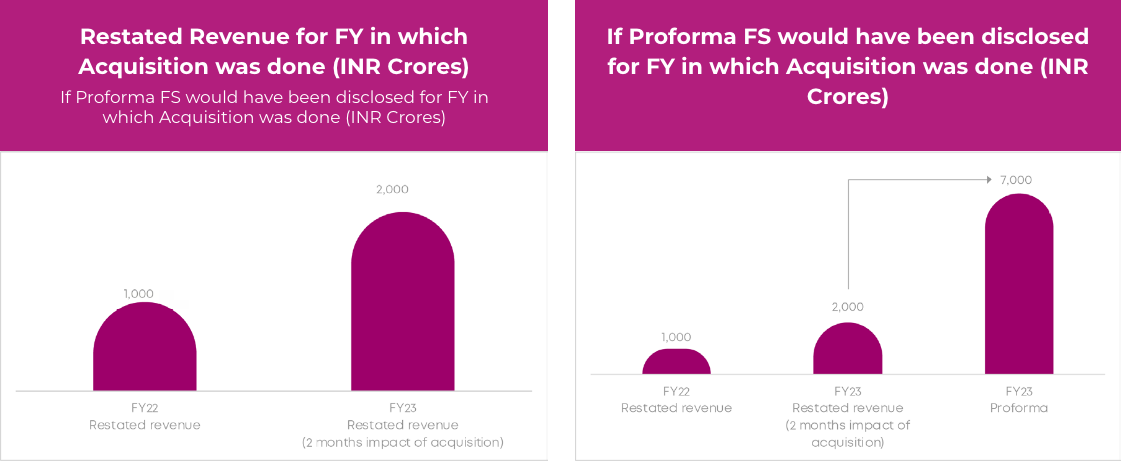

Scenario 2 – A company completes a significant acquisition in February 2023 and prepares a DRHP with consolidated financial statements for FY 2023, FY 2022, and FY 2021. Only two months of the acquired company’s financials are included for FY 2023 (February and March), which could lead investors to underestimate the acquisition’s full impact on the company’s financials. Voluntary proforma financials for the full fiscal year would allow investors to see the acquisition’s effect on an annualized basis, offering greater clarity on the acquisition’s implications for revenue, expenses, and overall financial health.

Voluntary Inclusion of Proforma FS even if Acquisition Consummated Prior to Completion of Last FY

Significant Acquisition done prior to completion of FY and thus no Proforma FS disclosed in DRHP

If Proforma FS would have been disclosed for FY in which Acquisition was done (INR Crores)

If Proforma FS would have been disclosed for FY in which Acquisition was done (INR Crores)

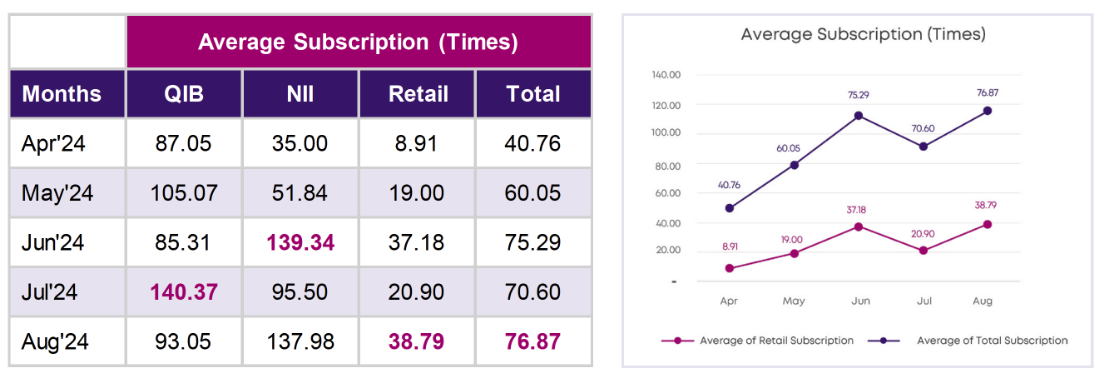

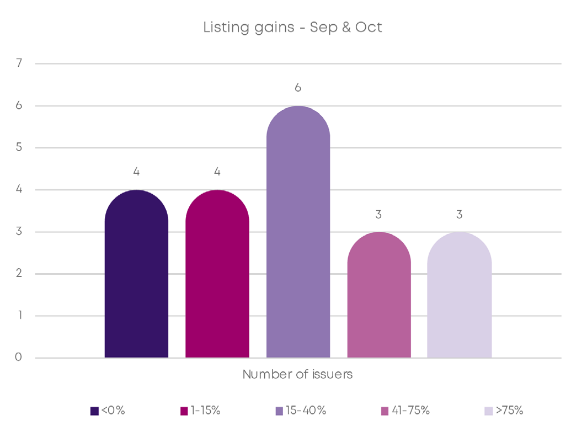

Distribution of listing gains by number of issuers

Distribution of listing gains by number of issuers Top 5 Issuers by listing gains

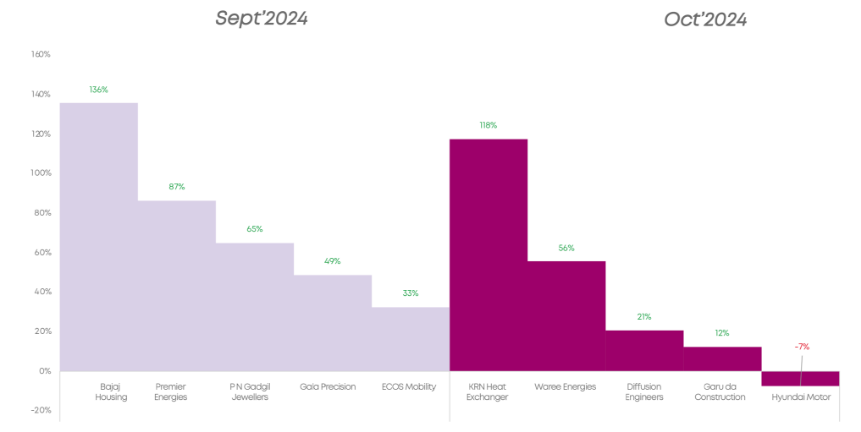

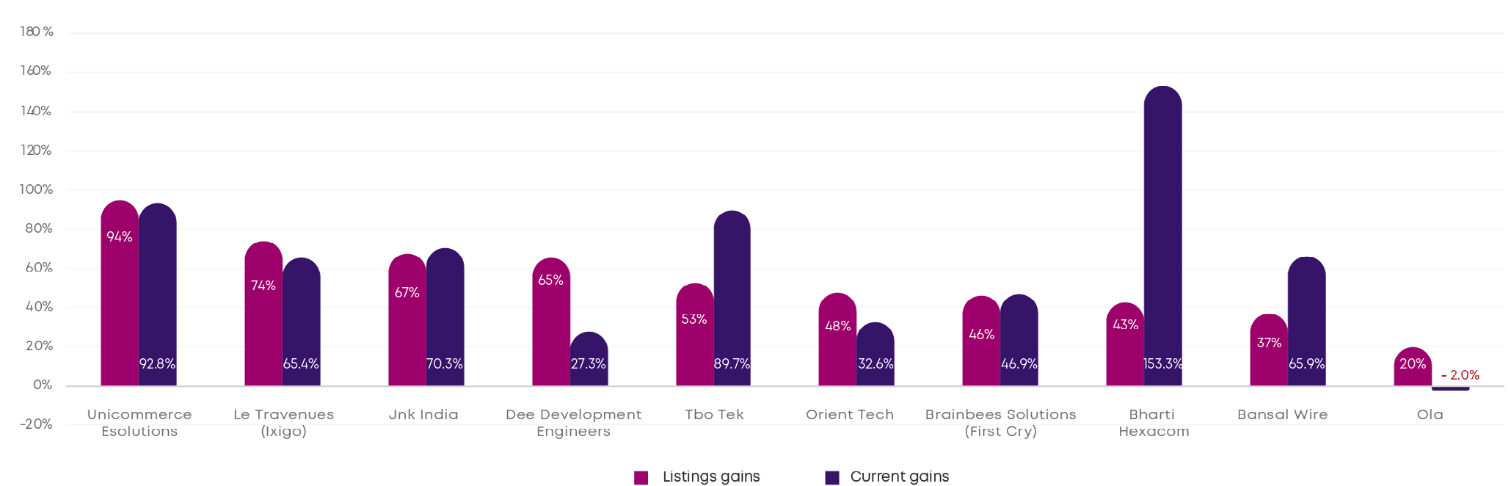

Top 5 Issuers by listing gains

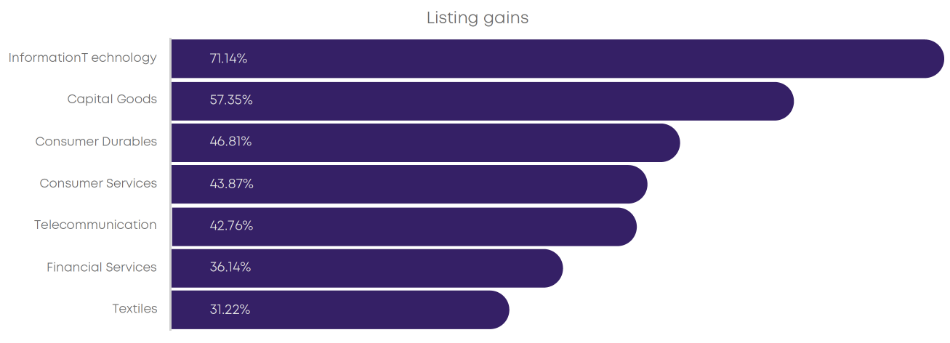

Sector contributing to major listing gains

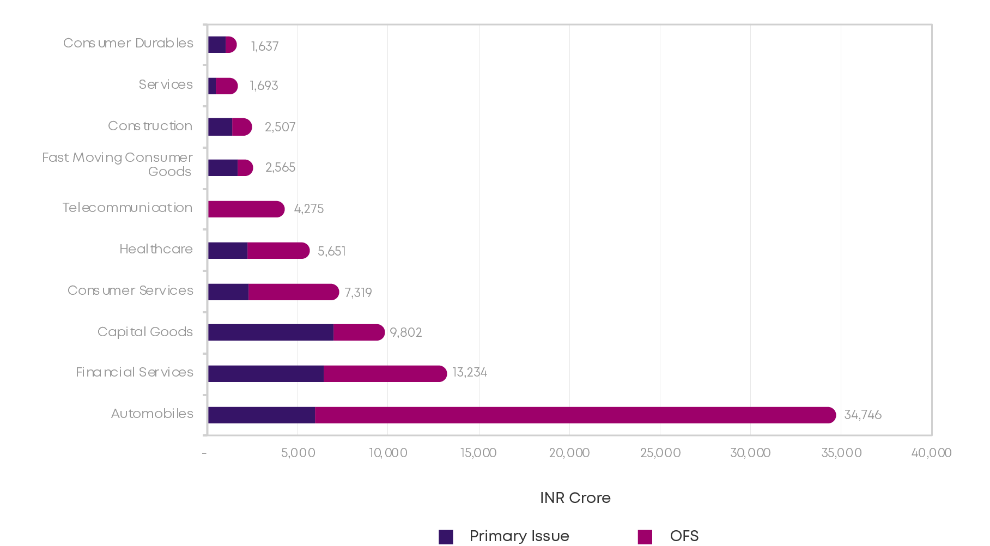

Sector contributing to major listing gains Industry trends

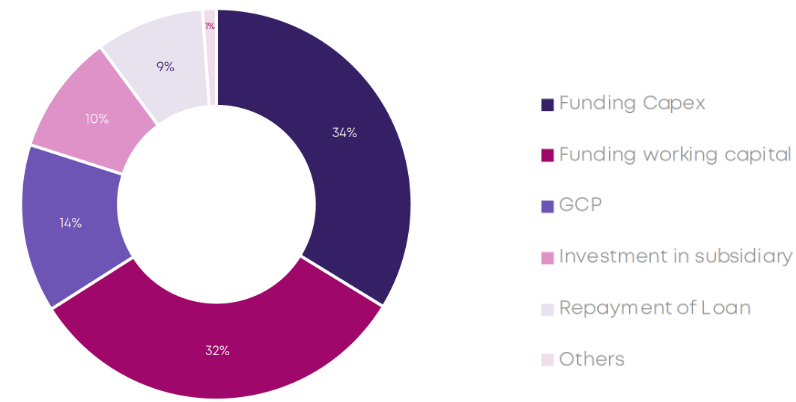

Industry trends Proposed use of proceeds (Sep-Oct 2024)

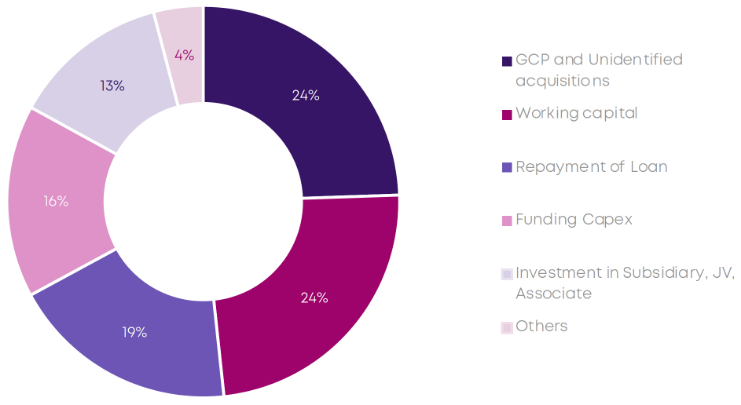

Proposed use of proceeds (Sep-Oct 2024) Proposed use of proceeds (Apr-Oct 2024)

Proposed use of proceeds (Apr-Oct 2024)