Our Point of View

The proposed approach in the DP on ECL is principlesbased along with regulatory backstops, wherever necessary. The DP seeks to cover all scheduled commercial banks and covers most financial assets within the scope of ECL based provisioning. The RBI has also sought comments on a range of issues pertinent to implementation of ECL including whether regional rural banks and smaller cooperative banks should be kept out of the above framework.

The proposed DP is largely consistent with IFRS 9 / Ind AS 109 with some carve outs. The financial assets in scope are required to be categorized as Stage 1, Stage 2, and Stage 3, depending upon the assessed credit losses on them and estimate provisions are based on12 month or lifetime Probability of Default (‘PD’).

It is indicated that banks would be allowed to design and implement their own models for measuring ECL with certain mitigants expected to be stipulated by the RBI. Further, provisions as per the Banks’ internal assessments shall be subject to a prudential floor, to be specified by the RBI based on comprehensive data analysis. To facilitate a seamless transition, as permitted under the Basel guidelines, the RBI has provided an option to phase out the effect of increased provisions on Common Equity Tier I capital, over a maximum period of five years.

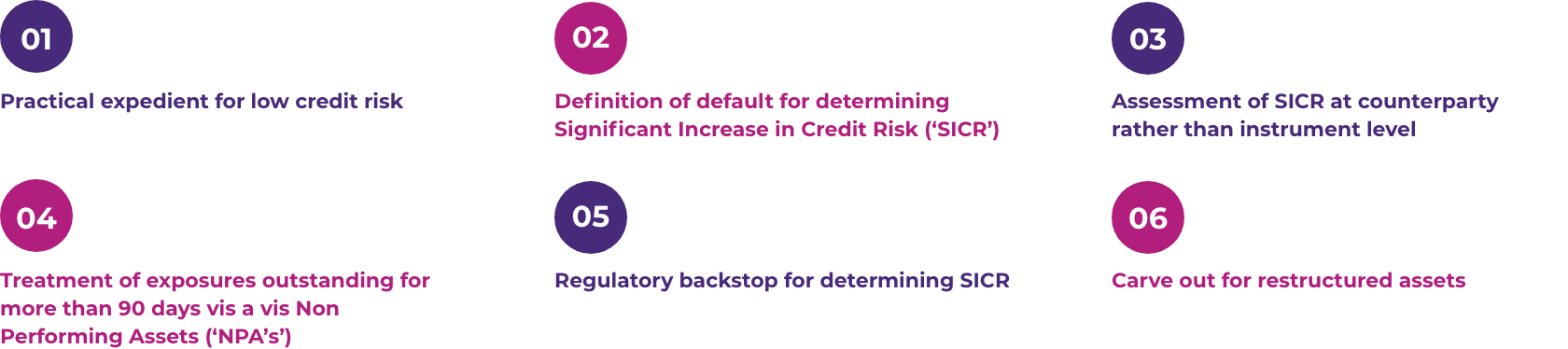

We believe it is important to take a holistic view of implementing the ECL based approach as there are nuances that affect financial statements and regulatory submissions. In this context, the DP captures interlinkages arising from matters that impact both accounting and capital adequacy. For your perusal, following is the summary of our responses to the RBI’s DP on ECL based approach. The responses to issues raised in the DP have been grouped based as follows:

Overall approach

The RBI has enquired if ECL per IFRS 9 should be adopted as compared to the Current Expected Credit Losses (‘CECL’) and if there should be regulatory backstops alongside principle-based guidelines.