Executive Summary

IFRS 18, Presentation and Disclosure in Financial Statements, issued by the IASB, substantially changes the structure and presentation of financial statements. It brings a renewed focus on amanagement-relevant metrics and investor-aligned disclosures. The key concepts introduced under IFRS 18 are:

Categories in the Statement of Income

- Classify income and expenses into five categories – Operating, Investing, Financing, Taxes, and Discontinued Operations.

- FX gains/losses should be presented with the related income/expense category.

- Derivatives gains/losses are presented based on their function or purpose within the business.

Disclosure of Management-defined Performance Measures

- Performance measures shared publicly must now be formally included in financial statements and audited.

- Performance measures that represent subtotals of income and expenses will be included.

- Management-defined Performance Measures (MPMs) must be defined, disclosed, and reconciled with the nearest IFRS-compliant figures.

Enhanced guidance on aggregation and disaggregation

- Provides comprehensive guidance on the grouping (aggregation and disaggregation) of information to be included in ‘primary’ financial statements and on the information to be disclosed in the notes.

- Provides option to disclose summary of expenses, either nature-wise or function-wise, or both.

What does this mean for banks in the region?

- P&L Reclassification: Reclassifying items such as exchange income, non-trading gains, dividend income, etc., into Operating, Investing, or Financing categories alters key metrics such as Operating Profit, requiring clear stakeholder communication.

- Chart of Accounts (CoA) Redesign: CoA structures must be reengineered to support IFRS 18 categorization logic, especially for banking groups with mixed-activity subsidiaries, where consistent mapping is key for consolidation.

- Transparency in MPMs: Mandatory disclosure and audit of MPMs (e.g., adjusted Net Commission Margin, adjusted return for computing return on average assets (ROAA)) enhance investor trust but increase governance and system configurations to support such MPMs’ reconciliations with reported figures in the income statement.

- Regulatory Alignment Challenges: Aligning IFRS 18’s classifications with SAMA, Basel III, FINREP, and COREP frameworks creates dual reporting burdens, necessitating regulatory collaboration.

- Reporting Process Overhaul: Enhanced disaggregation and MPM requirements demand system upgrades, data granularity, and staff training to ensure compliance by 2027.

Classification of Income and Expenses

For example, If the specific main business activity is to ‘invest in assets’ and ‘provide financing to customers’, the resulting income and expenses must generally be reported in the operating result.

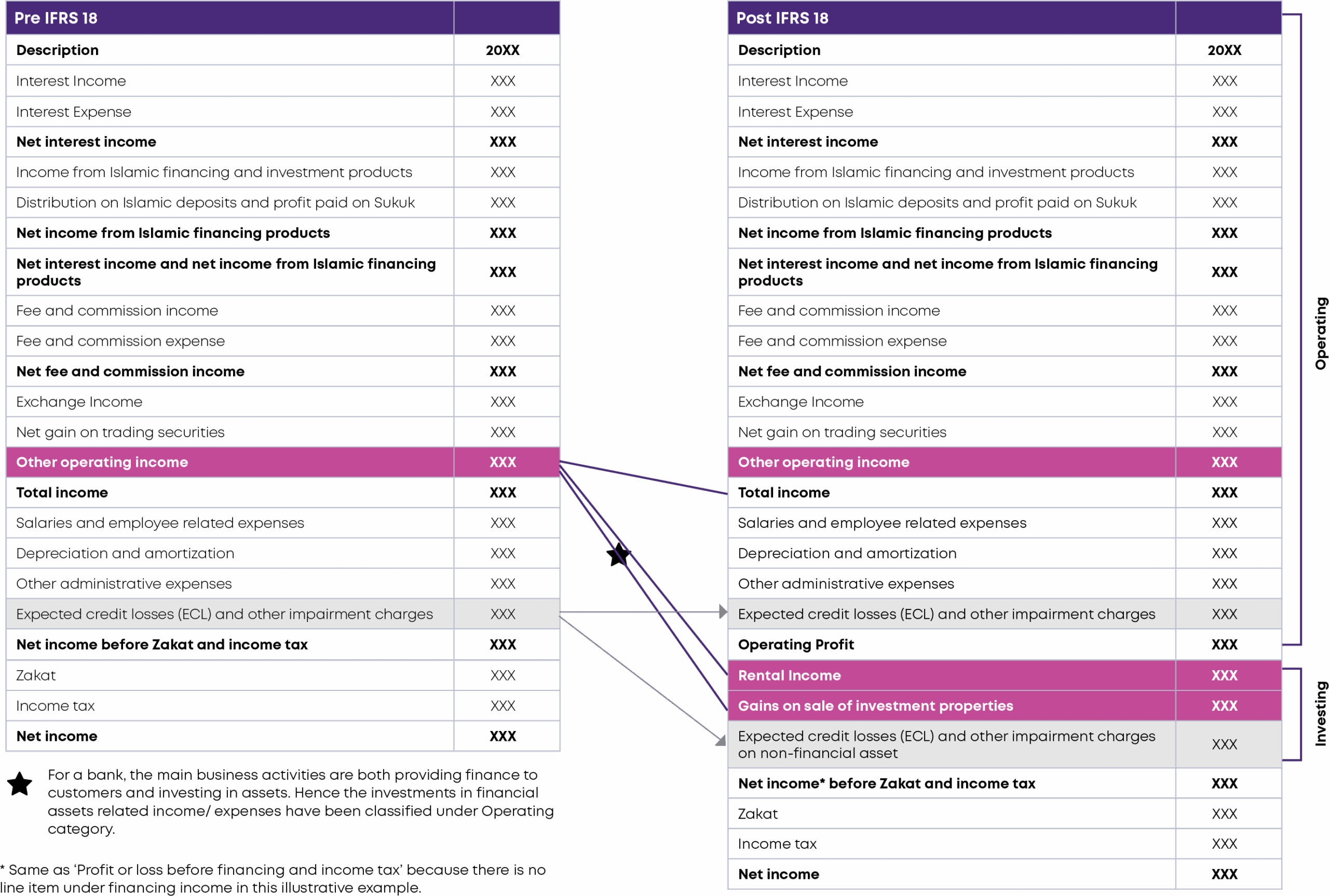

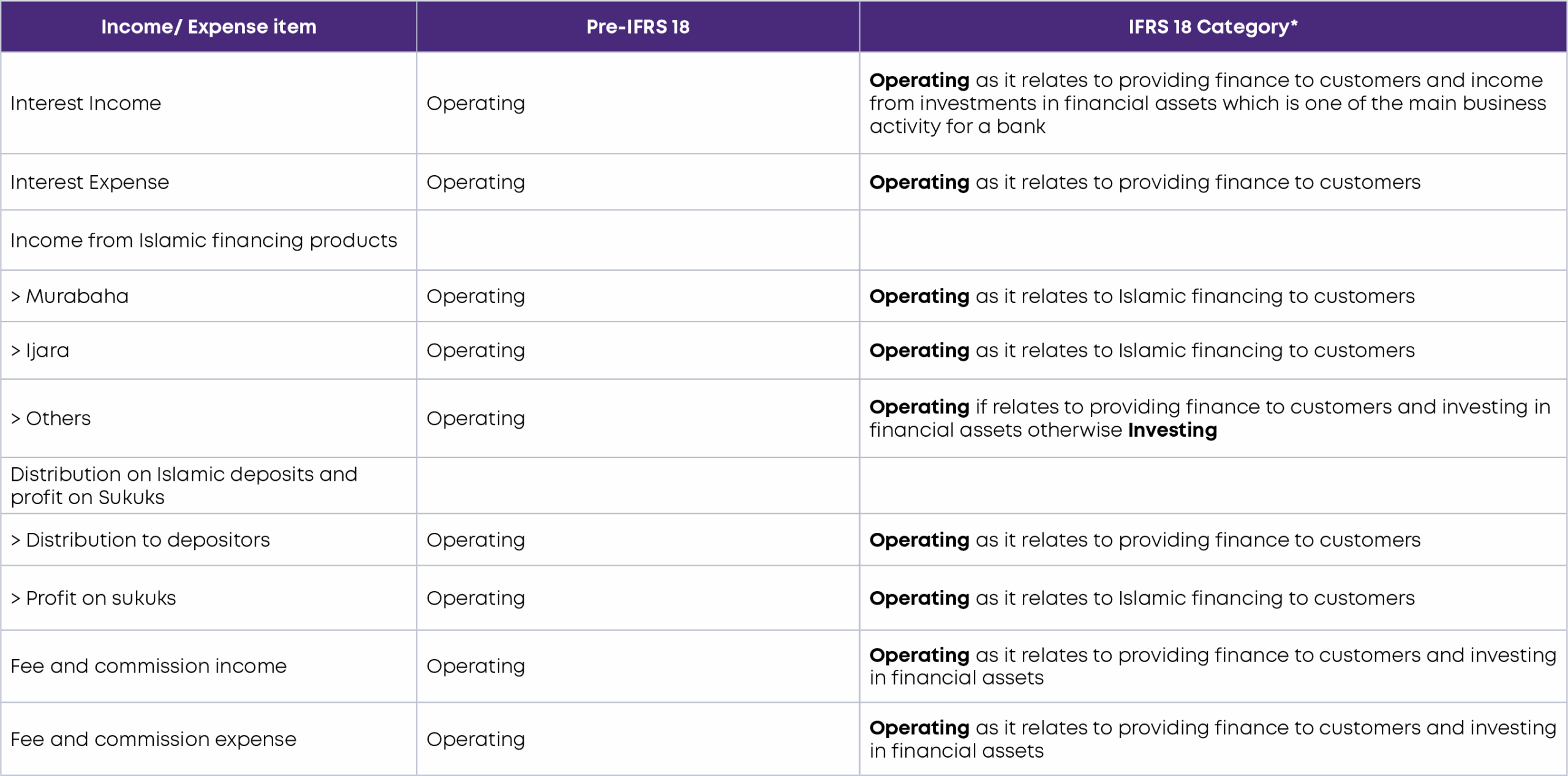

Retail & corporate banks primarily tend to engage in providing financing to customers. Accordingly, the indicative categorization of results/net income would look as follows:

Operating

- Income and expenses from financing to customers* – e.g. Gross financing and investment income (including expenses from borrowing of funds), Fees from banking services, etc.

- Income and expenses from investments in financial assets like fair value changes, profit/ loss on sale of investments.

Investing

- Result from associates and JV accounted for using the equity method.

- Income and expenses from investment property like rental income, impairment loss relating to the investment property, profit/ loss on sale of investment property.

Financing

- Interest expenses and effects of changes in interest rates on other liabilities (e.g: interest on lease liabilities).

- Expenses from financing liabilities that do not relate to providing financing to customers.

Standalone v/s Consolidated Classification

Why this matters: Determining the main or specified main business activity is foundational under IFRS 18, which governs how key income and expense items are classified in the statement of profit or loss. This classification directly influences how financing income, returns to depositors, investment gains, and fee-based revenues are split between Operating, Investing, and Financing activities for banks and banking groups.

Strategic Implications for Banking Groups

One Group, Multiple Realities: Subsidiaries may individually qualify as having a specified main business activity (e.g., leasing, asset management), while the group as a whole does not. This divergence impacts how Financial Statement Line Items like financing income, gains on investments, or operating expenses are classified at the consolidated level.

Consolidation May Shift the Lens: What qualifies as operating at an entity level (e.g., leasing income, asset management fees) may be reclassified as investing or financing at the group level, reshaping reported operating profit and KPIs.

Impact on Systems & Reporting: Requires alignment of the chart of accounts, granular tagging of income/expenses, and flexible reporting infrastructure to support dual views – regulatory (e.g., SAMA) vs. IFRS 18-compliant.

Consistency and Judgment Are Critical: Management must apply classification judgments consistently across entities, document rationale, and prepare for auditable disclosures when reclassifications occur or judgments evolve.

Categories-wise Mapping for Banks

To read this section in detail, download the PDF

Illustrative Income Statement Pre v/s Post IFRS 18

Impact on Chart of Accounts (CoA) for Banks

- Re-mapping income and expense accounts: Key FSLIs such as special fee and commission income, gains/losses on non-trading investments, interest expense on lease liabilities to Operating, Investing, or Financing categories, based on the group’s main business activity and IFRS 18 principles.

- Group-wide standardization: Banking groups with subsidiaries in asset management, investment banking, or leasing must introduce CoA logic that accommodates entity-level vs. group-level classification differences, especially during consolidation.

- Dual-tagging for flexibility: Many banks will need to introduce dual tagging or categorization flags in their CoA, one for regulatory/management reporting (e.g., SAMA) and one for IFRS 18 presentation, to avoid duplication and maintain traceability.

- System enablement and flexibility: Core banking and ERP systems must support flexible account mapping, allowing for multi-dimensional classification (e.g., one dimension for regulatory codes, one for IFRS category), especially for recurring items like financing income, returns to depositors, and fee & commission income.

- Internal governance and controls: Provides a competitive edge by demonstrating a proactive approach to managing risks and ensuring continuity of operations.

Management-defined Performance Measures

Non-GAAP performance measures are a subtotal of income and expenses included in press releases, management commentaries, and investor presentations.

Measures which are not a MPM

- Measures pertaining to assets, liabilities, equity, and cash flow.

- Regulatory metrics like leverage ratios, CET 1 ratios, liquidity coverage ratio, etc.

- Financial ratios (e.g., return on assets, net interest margin) are not MPMs — however, any subtotal of income and expenses used within the ratio may be an MPM (e.g., adjusted return used in adjusted return on equity).

- Subtotals that depict the difference between a type of revenue and directly related expense, e.g., Net special commission income, Gross profit or loss.

- A measure used internally and not referred to for public communications.

To read this section in detail, download the PDF

Aggregation and Disaggregation

The disaggregation guidance requires entities to present income and expenses in sufficient detail to provide useful information, avoiding overly aggregated line items. This also involves breaking down P&L items (e.g., fee income, interest income, impairment losses) by nature, type, function or other relevant characteristics.

Current Disclosures

- Interest and similar income / expenses is disaggregated into different source of these income / expenses.

- Income from Islamic Financing and distribution on Islamic Deposits is disaggregated into various products.

- Fee and commission income / expenses is disaggregated based on nature of businesses.

- Other operating income is disaggregated into rental income, asset disposal and Dividend and Foreign Exchange Income (Illustrative).

- Forex exchange gain or loss is not disaggregated.

- ECL is presented separately for classes of assets like loans and advances, other financial assets and commitments and contingencies.

- No disaggregation of other general and administrative expenses is provided.

IFRS 18 impact

- Analysis to determine if further disaggregation of fee and commission by nature is required under IFRS 18.

- Dividend and Gain on sale of investments shall be classified into operating category for a bank and further disaggregated by nature of investments for each category.

- Other operating income shall be disaggregated into income source and classified based on operating or investing nature

- Forex gain or loss shall be disaggregated by the type of items that led to the gain or loss like trading activity, hedging instrument, etc and shall be classified appropriately.

- ECL losses shall be classified based on operating or investing nature of underlying asset and further disaggregated by nature.

- Other general and administrative expenses shall be disaggregated into further items by nature.

To read this section in detail, download the PDF

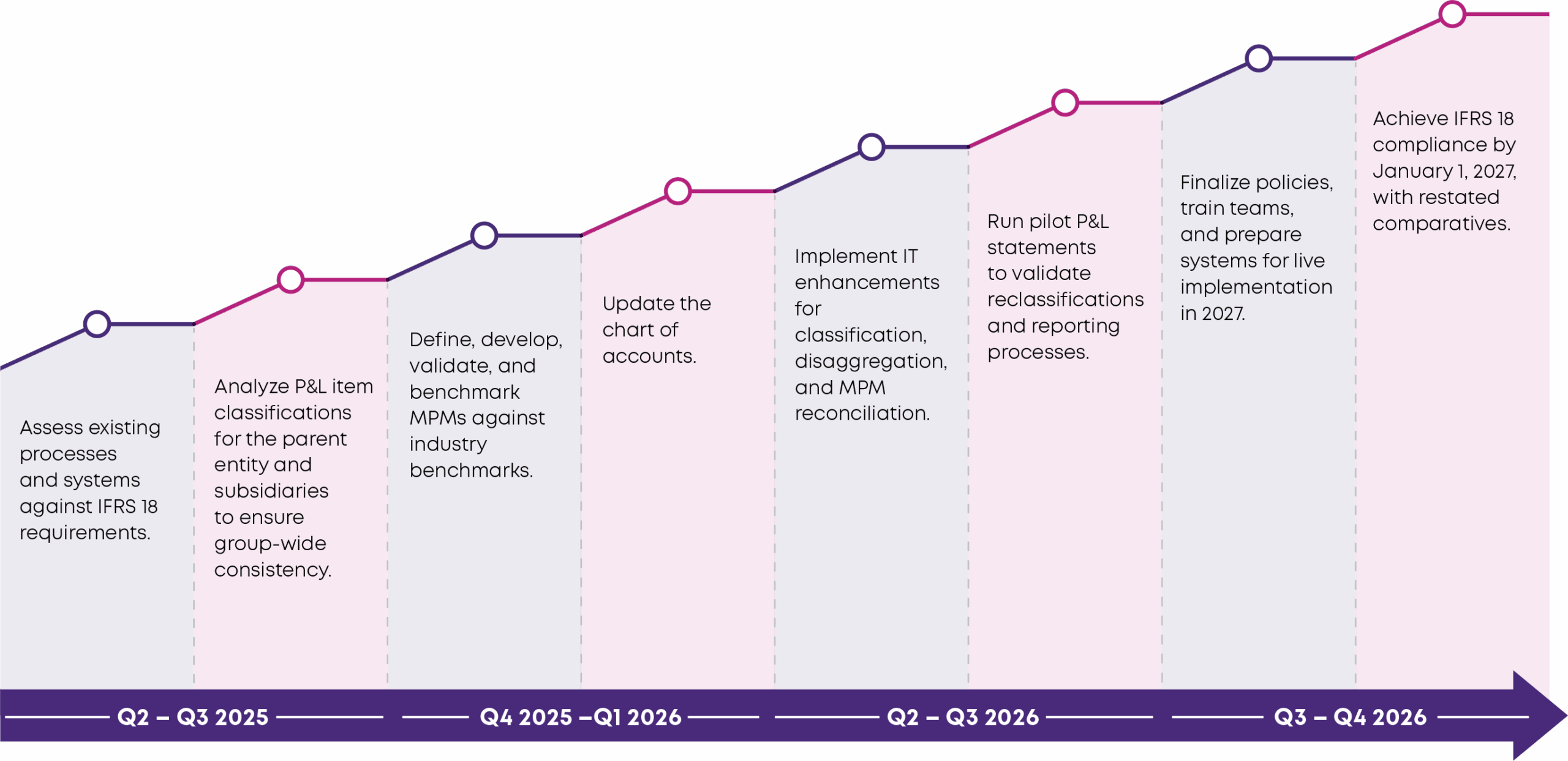

IFRS 18 Implementation Timeline

Key changes required

To comply with the IFRS 18 disclosure and presentation requirements, organizations must take a proactive and structured approach to the chart of accounts, data management, Internal controls & governance, and training and change management. Below are key steps:

Chart of accounts update

Requirement: The chart of accounts must support new classification categories, disaggregation rules, and MPM reconciliations.

Illustrative changes required:

- Update reporting system to tag P&L items (e.g., deposit expenses as Operating, trading gains as Investing).

- Enhance systems to disaggregate fee income by nature (e.g., advisory vs. transaction fees).

Data Management & Tech Enhancements

Requirement: Increased data granularity to meet disaggregation and MPM disclosure needs.

Illustrative changes required:

- Capture detailed data on P&L items ( e.g., fee income sources/ nature or trading gain components into operating/investing depending on the nature of investments).

- Implement real-time data feeds for dynamic P&L reporting.

Internal Controls and Governance

Requirement: Strengthened controls to validate reclassifications and MPMs for audit compliance.

Illustrative changes required:

- Establish audit trails for reclassified items (e.g., deposit expenses) and MPMs (e.g., adjusted NIM).

- Create governance frameworks to ensure consistency in classification decisions.

Financial Close & Accounting Policies

Requirement: Ensure IFRS 18 classifications and disclosures are embedded in close processes and governance documentation.

Illustrative changes required:

- Align FSCP timelines to accommodate new classification validations and MPM disclosures.

- Update accounting policy manuals to reflect revised definitions of operating, investing, and financing categories.

- Embed review checkpoints for classification judgments during monthly/quarterly closes.

Also refer to our recent thought leadership on IFRS 18 for a general overview of the requirements for all industries.