Executive Summary

Earlier this year, the RBI issued a DP on provisioning as per the ECL approach which was largely acknowledged as a paradigm shift in how banks in India were required to provide for financial assets like loans and investments. In response to comments received from stakeholders, the RBI issued a press release on 04 October 2023 and announced the constitution of a working group for independent inputs on technical aspects pertaining to ECL. While the final directions on ECL based provisioning is awaited, the RBI issued final directions on Classification, Valuation, and Operations of Investments on 12 September 2023. The issuance of revised directions on Classification, Valuation and Operations of investments marks a significant shift in financial reporting requirements for banking entities.

Currently, Banks prepare financial statements in accordance with I GAAP. The financial reporting framework under IGAAP comprises directions stipulated by Third Schedule of the Banking Regulation Act, 1949, various guidelines issued by the RBI over a period, the Accounting Standards (‘AS’) specified under Section 133 of the Companies Act, 2013 read together with the Companies (Accounts) Rules, 2014 and the Companies (Accounting Standards) Rules, 2021. Furthermore, disclosures stipulated under IGAAP do not cover policies, process and systems relating to risk management which are pertinent to better understand financial performance and results of a banking company.

In this publication, we have covered the journey on transition to Ind AS, key issues to be addressed during transition to Ind AS based on our global and local experience of implementing IFRS 9 & Ind AS and a point of view on the timing of transition to Ind AS by banks in India.

Journey so far

To facilitate Indian entities access to international markets without having to go through cumbersome conversion and filing process, the Council of Institute of Chartered Accountant of India (“ICAI”) at its 269th meeting held on 18th July 2007 had decided that public interest entities such as listed companies, banks, insurance companies, and large-sized organizations converge with IFRS for accounting period commencing on or after 1 April 2011.

To facilitate Indian entities access to international markets without having to go through cumbersome conversion and filing process, the Council of Institute of Chartered Accountant of India (“ICAI”) at its 269th meeting held on 18th July 2007 had decided that public interest entities such as listed companies, banks, insurance companies, and large-sized organizations converge with IFRS for accounting period commencing on or after 1 April 2011.

While the process for convergence of IND AS was underway, certain issues pertaining to taxation, Company Law, and other regulatory frameworks emerged. As a result, the Ministry of Corporate Affairs (“MCA”) decided to postpone the implementation of IND AS so that these issues could be addressed. The government in its budget for the year 2014-2015 had announced adoption of the new Indian Accounting Standards (‘Ind AS’) by Indian companies from the financial year 2015-16 on a voluntary basis and from the financial year 2016-17 on a mandatory basis. Further, MCA had laid down a road map for adoption of Ind AS by the specified companies in a phased manner.

The MCA vide press release dated 18th January 2016, deferred Ind AS implementation for Scheduled Commercial Banks (‘SCBs’) to accounting periods commencing 1 April 2018 in order to avoid two rounds of implementation efforts, first with IAS 39 and then IFRS 9.

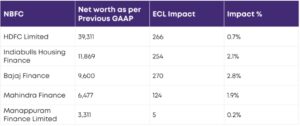

Meanwhile to encourage banks to accelerate preparedness for Ind AS implementation, the RBI with its notification dated 23rd June 2016 directed SCBs to submit proforma Ind AS Financial Statements along with significant accounting policies from the half-year ended 30th September 2016, onwards. Subsequently, RBI vide notification dated 05th April 2018 deferred the implementation of Ind AS for banks by one year considering the proposed legislative amendments required to enable implementation of Ind AS by SCBs. Furthermore, RBI vide notification dated 22nd March 2019 deferred the implementation of Ind AS for banks till further notice as legislative amendments were still under consideration of the Government. In the recent past, the RBI issued DP on accounting for investments and provisioning per the ECL approach and sought comments from public at large. On 12th September 2023, the RBI issued directions on Classification, Valuation and Operation of Investments. The directions aim to align reporting norms for investments with global standards.. The final directions on ECL based approach to provisioning are awaited from the RBI. However, the RBI has constituted a working group to provide inputs on technical aspects having a bearing on transition to ECL based approach of provisioning. Several banking conglomerates in India have within their group, Non-Banking Finance Companies (‘NBFC’s’) and companies who have transitioned to Ind AS for statutory financial reporting purposes. However, as the parent entity i.e., banks continue to prepare statutory financial statements per Indian GAAP, such group entities continue to be saddled with incremental compliance obligation of preparing fit for consolidation accounts as per Indian GAAP and also get those audited by their statutory auditors for consolidation purposes. While presently there is no clarity on whether and when banks in India will transition to Ind AS, we believe with the issuance of revised directions on accounting for investments, the RBI has taken a significant step forward to facilitate transition to Ind AS by banks. Also, the formation of working group on ECL based provisioning seems to suggest implementation of ECL may be round the corner. In this publication, we have articulated nuances that need to be addressed to facilitate seamless transition to Ind AS by banks in India.

Key Impacts arising from Ind AS for Banks

1. Expected Credit Losses – Impact on profits and capital

Currently, banks follow the incurred credit loss method to provide for Non-Performing Assets (“NPA”). Provision for NPA’s is recognised in line with RBI guidelines on Income Recognition, Asset Classification and Provisioning (‘IRACP’). These directions stipulate provisioning to be recorded at specified percentages and leave very little room for use of management judgment or forward-looking factors to determine provisions required to be held. Under Ind-AS, loan loss provisioning will need to be recognised ab-initio with due consideration of portfolio segmentation, empirical data on defaults, recoveries along with macro-economic factors to arrive at a probability weighted outcome of provisions required to be held. The application of ECL methodology calls for extensive iterations as the accuracy of calculations depend immensely on data availability, data quality and use of modelling techniques to arrive at Exposure At Default (‘EAD’), Probability of Default (‘PD’) and Loss Given Default (‘LGD’). The ECL methodology also applies to computation of provisions on financial assets such as debt investments, undrawn commitments and off-balance sheet exposures like financial guarantees, performance guarantees etc.

Following are key proposals and implications of ECL based provisioning as per the DP on ECL issued by RBI on 16th January 2023:

01) Banks to classify financial assets (primarily loans, including irrevocable loan commitments, and investments classified as held-to-maturity or available-for-sale per Indian GAAP) into one of the three categories – Stage 1, Stage 2, and Stage 3, depending upon the business model and assess credit losses on them, at the time of initial recognition as well as on each subsequent reporting date and make necessary provisions.

02) The proposed framework would entail significant management judgement while computing ECL, and thus it is imperative to provide enhanced and detailed disclosures to stakeholders to ensure transparency.

03) Banks to ascertain whether significant increase in credit risk has occurred on a reporting day as compared to initial recognition, and to measure and provide for the expected credit losses subject to the regulatory backstops such as prudential floor for loan provisions. It may be possible that, similar to the Investment Directions issued by the RBI on 12 September 2023, the eventual ECL approach applied by banks in India may not be fully comparable with ECL approaches used by their global peers, basis the approach prescribed in the DP. In this context, it is pertinent to weigh the pros and cons of regulatory backstops for financial reporting vis a vis regulatory reporting. One possible approach is to let statutory financial reporting be driven by accounting standards i.e., Ind AS 109 for ECL and regulatory backstops be applied for purposes such as determination of capital adequacy ratio. However, it is also pertinent to note that banking regulators in countries like United Arab Emirates (‘UAE’), Saudi Arabia, Qatar, Bahrain, and Oman have implemented IFRS 9 in its entirety along with certain deviations for computing the ECL as per guidelines issued by their respective banking regulators. Annexure 1 captures differences between requirements of IFRS 9 and regulatory guidelines stipulated by banking regulators in aforesaid countries.

04) Stage migration between stage 1, 2 and 3 will be majorly based on significant increase in credit risk of the financial asset. For financial assets which have been classified as Stage 3, a Stage 1 classification will not be an automatic Days Past Due (‘DPD’) based calculation. Such a financial asset will continue to be classified as Stage 2 for minimum six months after all the irregularities are rectified In our view, cooling period for stage migration proposed in the DP will facilitate a more realistic assessment of the unlikeliness to pay and possibly result in a higher estimate of provision required to be held. It will also help mitigating a transient rectification of the irregularity / deficiency near the reporting date.

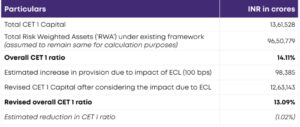

05) The guidelines include transitional approach that would permit the impact of an increase in the Common Equity Tier 1 (“CET 1”) capital to be phased out over a maximum period of five years.

2. The Changing Landscape of Investment Portfolio and Valuation

In October 2000, a framework was established for the classification and valuation of investment portfolios by commercial banks, reflecting the global practices and standards of the time. However, the financial landscape has evolved significantly since then, with the adoption of IFRS 9 as a global standard for banks from 1st January 2018. Recognizing these changes, the RBI has updated its norms through the Master Direction – Classification, Valuation and Operation of Investment Portfolio of Commercial Banks (Directions), issued on 12th September 2023. These revised guidelines will be applicable to all commercial banks (excluding Regional Rural Banks) from 1st April 2024.

Key highlights of the new circular

1. A step forward towards aligning with Ind AS 109 for banks, promoting some uniformity in the reporting framework with NBFCs and listed corporates in India.

2. Implementation of a business model and intent-based classification that will need to align Key Performance Indicators (KPIs) of business desks, resulting in accounting that reflects actual business decisions.

3. Introduction of credit assessment for investment portfolio as per IRACP norms, enhanced documentation for business model and valuation of investments.

4. Additional disclosures for enhanced comprehension by users of financial statements.

Key deviations vis-à-vis Ind AS requirements

i. Additional sub-category of Held for Trading (‘HFT ‘) introduced within category FVTPL.

ii. Transfer to be made from AFS reserve to Capital reserve on sale of equity classified as AFS and sale out of HTM portfolio.

iii. Instead of ECL, the criteria used to classify an asset as NPA as per the extant Prudential Norms on IRACP pertaining to Advances shall be used to classify an investment as a Non-Performing Investment (NPI).

iv. Absence of guidance on the derecognition requirements pertaining to securitization or assignment of financial assets, and the need for alignment with Ind AS 109 requirements.

v. No reference to assessment required as per Ind AS for subsidiaries and joint ventures. Instead, the revised directions refer to the existing Indian GAAP accounting standards for the definition of subsidiaries and joint ventures.

3. Effective Interest Rate (‘EIR’)

In current scenario, banks recognize processing fees on loans disbursed and borrowings upfront in the profit and loss account. Similarly direct origination costs, like Direct Marketing Agency (‘DMA’) costs are accounted for as and when they are incurred. However, Ind AS require recognition of interest income and interest expense on an EIR basis. Accordingly, directly attributable and incremental origination fees and costs are required to be amortised over the expected life of the financial instrument. The requirement to measure interest income and expense on an EIR basis applies to financial assets measured at amortised cost, debt investments measured at FVOCI, and financial liabilities measured at amortised cost. In our experience, following are key challenges associated with application of EIR retrospectively:

01. The lack of historical data on the contractual terms and cash flows of the financial instruments that may necessitate use of several assumptions.

02. Attribution of blended fees to multiple facilities for determination of EIR.

03. The complexity in EIR calculations due to terms such as expected cash flows, the benchmark interest rate, the initial effective spread, premiums or discounts, and the credit risk adjustments. 4. Additional disclosures for enhanced comprehension by users of financial statements.

04. Determining methodology (fixing the EIR rate at inception or adjusting the EIR for expected future interest rate at reporting date) for computing EIR for variable or floating rate instruments.

05. Computing foreign exchange gains/losses for debt instruments denominated in foreign currency and measured at amortised cost or fair value through other comprehensive income. It is likely that the approach and assumptions applied by banks may differ, which will result in inconsistent and incomparable EIRs across different financial instruments and reporting periods. Further, manual calculations are prone to errors and inconsistencies, especially when dealing with large volumes of financial instruments with different characteristics and features. We believe the need for automating EIR cannot be undermined considering the variants in cash flow features and other contractual terms.

4. Disclosures require extensive qualitative and quantitative information hitherto not compiled and not reported

IND AS 107 requires detailed qualitative and quantitative disclosures on various aspects of risk management. These include policies, processes and systems used to measure and monitor risks arising from exposure to financial instruments i.e. credit risk, liquidity risk, market risk and operational risk. Several of these disclosures are not required to be provided under Indian GAAP. Accordingly, banks will have to review existing data sources to establish accuracy of available information for external reporting. Further, all these disclosures are required to be audited and hence management will need to demonstrate governance on underlying information.