Setting the context

The advantages of adopting the New Standardized approach

Background

On 26 June 2023, RBI issued the guidelines for minimum capital for operational risk using the risk sensitive new standardized to Strengthen operational risk management frameworks in line with global best practices (e.g., Basel III). Guidelines are relevant to all the scheduled commercial banks. These guidelines replace all the existing approaches. The effective date of implementation of the guidelines has not yet been communicated by RBI. Still, however RBI expects the Banks to be ready with capabilities to be in place to implement the guidelines.

The Current Basic Indicator (BIA) approach uses an average of 3 years of gross income multiplied by an alpha of 15%; the new standardized approach includes the internal loss multiplier (ILM), which is multiplied by the business indicator component (BIC). The ILM can be derived from the entity’s own loss experience which can lead to considerable capital savings. The catch, however, is that the institution should have a formalized approach to loss data management and sufficiently establish that high-quality loss data is available for a minimum period of 5 years.

Further, to reinforce the Sound Management of Operational risk and resilience in the Banking industry, the RBI issued the Guidelines on Operational Risk Management and Resilience on 30 April 2024. These guidelines emphasize the requirement for strong internal controls to minimize operational disruptions and a robust loss data management framework.

Key advantages of Basel III SA

- Risk sensitive approach which uses the entity’s own loss experience

- Strong incentives to strengthen internal controls

- Freed up capital may be used to generate higher yields

- Better suited for Banks with strong Loss data management

Comparison of Basic Indicator Approach (BIA) vs. Standardized Approach (SA)

- Capital & Risk Computation Methodology

- Data Requirement & Governance

(Find the comparison table in the PDF)

Basel III SA will replace all the existing methods

The main components are a Business Indicator (BI), also a measure of an FI’s income, and a Loss Component (LC), from which an Internal Loss Multiplier (ILM) is derived. The Business Indicator Component (BIC) is obtained by multiplying the BI with the coefficient. The minimum operational risk capital requirement is the product of the BIC and the ILM, with risk-weighted assets for operational risk being this capital requirement multiplied by 12.5.

Illustration: Basic Indicator Approach (BIA) vs. Standardised Approach (SA)

The main components are a Business Indicator (BI), also a measure of an FI’s income, and a Loss Component (LC), from which an Internal Loss Multiplier (ILM) is derived. The Business Indicator Component (BIC) is obtained by multiplying the BI with the coefficient. The minimum operational risk capital requirement is the product of the BIC and the ILM, with risk-weighted assets for operational risk being this capital requirement multiplied by 12.5.

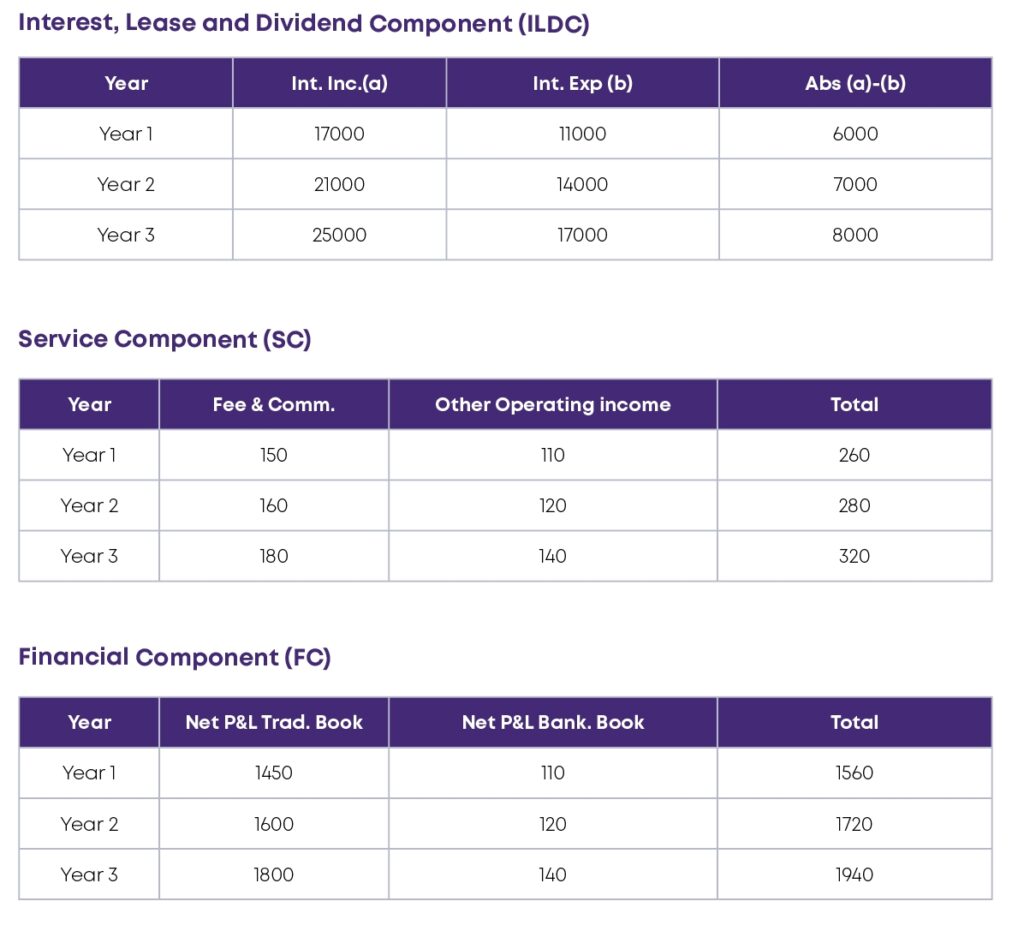

ILDC= 7000 crore, SC= 287 crore, FC= 1740 crore Average of three years.

BI = ILDC+SC+FC= 7000 crore + 287+ 1740 crore = 9027 crore.

Historical operational losses: Year 1: 400 crore Year 2: 200 crore Year 3: 150 crore Year 4: 200 crore Year 5: 100 crore over the last 5 years. Average Annual loss : 210 crore.

Mapping loss events as per Basel loss categories

- Internal fraud

- External fraud

- Clients, Products, and Business Practices

- Business Disruption and System Failures

- Execution, Delivery, and Process Management

- Damage to Physical Assets

- Employment Practices and Workplace Safety

Key Challenges & Mitigation Strategies

- Challenge

- Description

- Mitigation Strategy

How can we help?

Our tailored approach crafted to suit your needs

Diagnostic phase

As is an assessment of the existing operational risk framework i.e., the policies and procedures to understand the coverage regarding the loss data in terms of threshold, collection process, classification/mapping with the Basel loss categories, and reporting to committees if any

Discuss with risk function on ownership and with business units for present capabilities to identify and capture loss events including near miss events along with the mitigation measures such as controls or insurance in place

Review historical loss data collected in the last 10 years on a sample basis to ascertain the level of details captured and the root cause identified

Development phase

Loss Data Management Framework

Update the OR policy to capture the components of loss data and capital approach using the new SA

Develop the loss data collection template considering historical or likely losses and the Basel loss categories

Sensitize the stakeholders on a typical loss data lifecycle with a focus on:

Identification

Materiality

Accounting

Recovery

Reporting

Timing adjustments

Discuss with risk on how to roll out the loss data template across business units and re-constructing details of historical data basis on a sample basis

ORC Computation

Computation of OR Capital Charge

Map GL-level data with individual line items required for computation of BI i.e., ILDC, SC, and FC

Apply the appropriate margin coefficient and compute the BIC

Compute LC and ILM basis the available data and ensure the conditions of high quality are met else assume ILM as 1 as per guidelines

Compute ORC by multiplying BIC with the ILM and compare with BIA capital

Suggest necessary changes in the ICAAP document

Discussion with stakeholders on the impact on the capital under the new standardized approach and obtain sign-off

Why Us

Thought leaders

Deep and diverse talent pool

Global delivery model

Integrating financial and non-financial data management

Our technology-led approach

Next Steps

Next Steps